2022 Week 25

Notes, thoughts and observations - Compiled weekly

Crypto bro working at McDonald’s in the impressionist style (via Chamath Palihapitiya)

THIS WEEK

Fuel

Gimme fuel, gimme fire Gimme that which I desire - Metallica

- No slow down and consumer demand for fuel

- Summer driving season is upon us

- Two years of pent-up vacation demand

- Diesel remains elevated

- Ripple effect into transportation prices

- Will continue to fuel inflation

- Energy companies hesitant to invest in wells and infrastructure

- Cancelation of Keystone pipeline has companies wary to invest

- Current administration is tough on oil & gas, but avoided an outright ban on fracking

- THOUGHTS: November election may be an early indicator

- Republican victories in mid-terms could mean a possible shift in the presidency

- A republican administration may be more favorable to oil & gas, but no guarantee

- Could see a second bull rally in energy sector if we avoid a recession

- Republican victories in mid-terms could mean a possible shift in the presidency

Inflation

Inflation feels good at first, but the endgame is grim - Jens O. Parsson

-

Inflation numbers high again… we are shocked!!

-

If we intend to fight inflation with higher interest rates it will take time to work through the system

-

“This time it’s different” not exactly, but our post-COVID habits have changed

- OBSERVATION :: It’s always the same, but a little different. Something always changes

-

J. Powell raise target rates 75 basis points, between 1.50% - 1.75%

- It was an aggressive move, but they are feeling the political pressure to “do something”

- Wall Street already assumes there will be no “soft landing”

- THOUGHT :: Might see a panic if we cross the psychological threshold of 2.25% - 2.50% (2019 high)

-

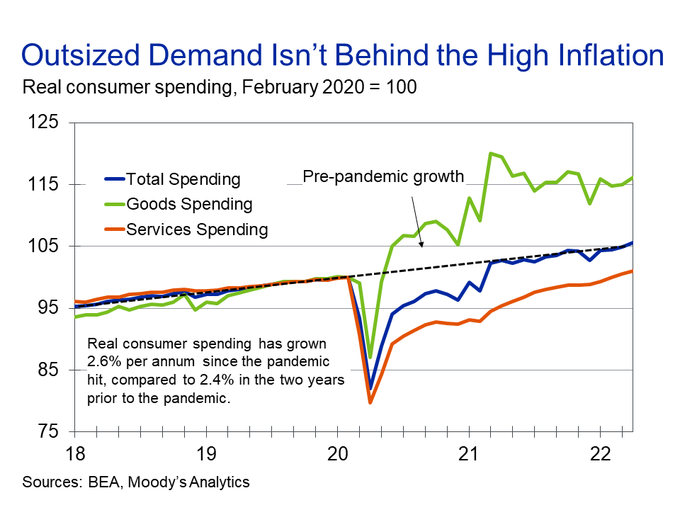

Demand is back to pre-COVID levels, but how we are spending has changed

That the high inflation has been so persistent has been a surprise, certainly to me. But so too has been the ongoing pandemic – the vaccines that became available over a year ago didn’t bring an end to it. And the Russian invasion wasn’t even on the radar screen. - Mark Zandi

-

Recession

It’s a recession when your neighbor loses his job; it’s a depression when you lose yours. - Harry S Truman

- Make no mistake, the Fed intends to fight inflation by tamping down on demand

- There is an INCREASING high probability this will go too far and pitch us into a recession

- Wall Street is already reacting and punishing the market

- OPINION :: Be on the lookout for several things

- Decline in demand for gasoline, will signal a strong pull back in consumer spending

- Real estate listing price reductions

- Companies will reduce projected earnings / fail to meet earnings expectations