2024 Week 10

Notes, thoughts and observations - Compiled weekly

Job growth in the US continues to be strong, even if it slightly missed expectations. The trades, transportation, construction and utilities all continue to see growth. White collar job losses in professional and business services might make headlines, but otherwise the employment picture is good.

Abroad we are seeing weakness and recession, but the prevailing opinion is that the US will nail a soft landing and avoid outright recession.

Globally energy prices, supply chain disruptions and civil unrest all pull economies in a negative direction. Eygpt is the latest nation to hike interest rates to combat inflation.

Residential real estate continues to be strong, but a recent survey confirmed that rental rates are either flat or declining slightly. This after skyrocketing prices in 2021 and 2022.

One key to the US economic strength is domestic energy production, which stands at an all-time high. In fact, the price is so cheap that production cuts seem likely. Long term this is good as the US will dictate its own energy supply for decades to come.

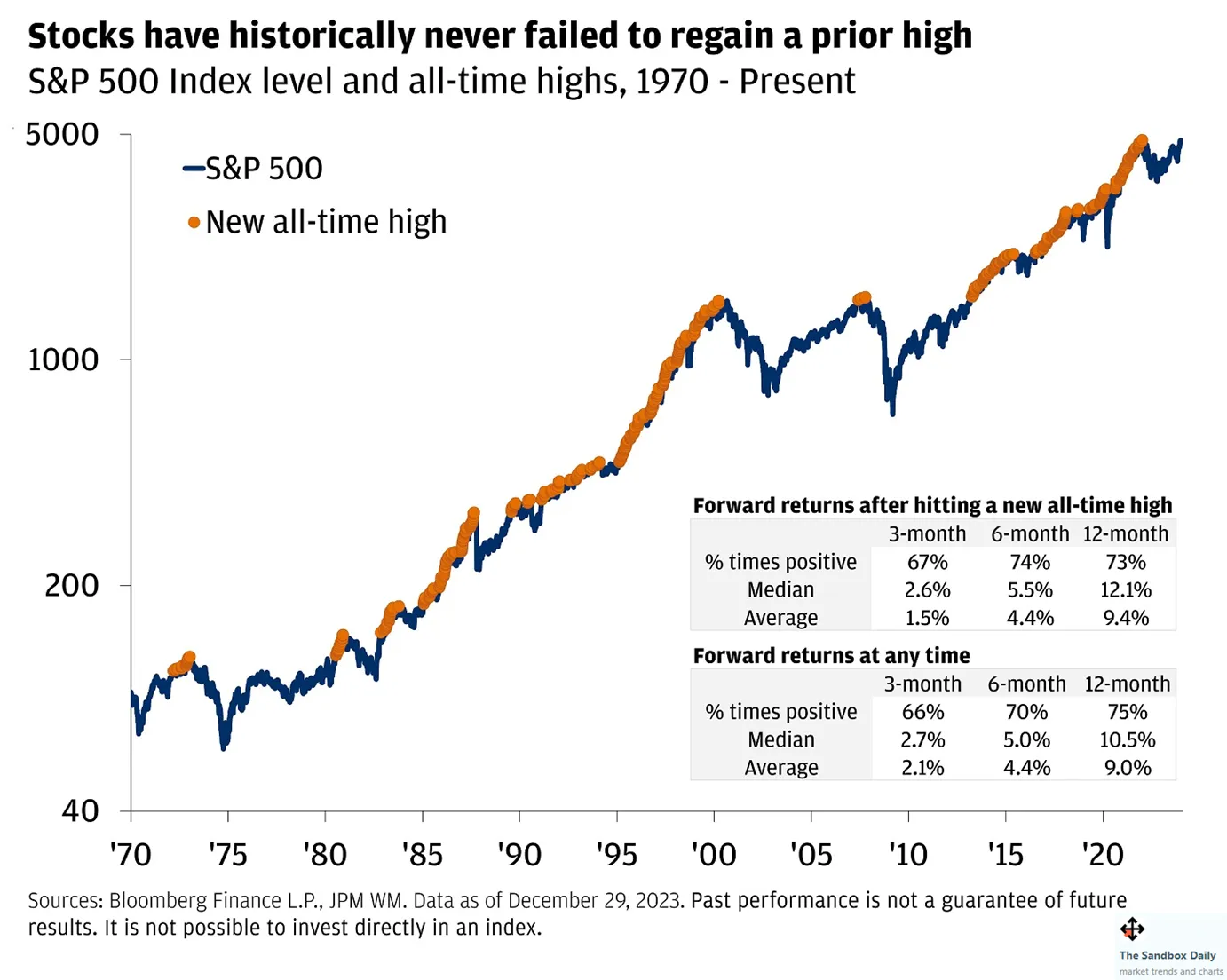

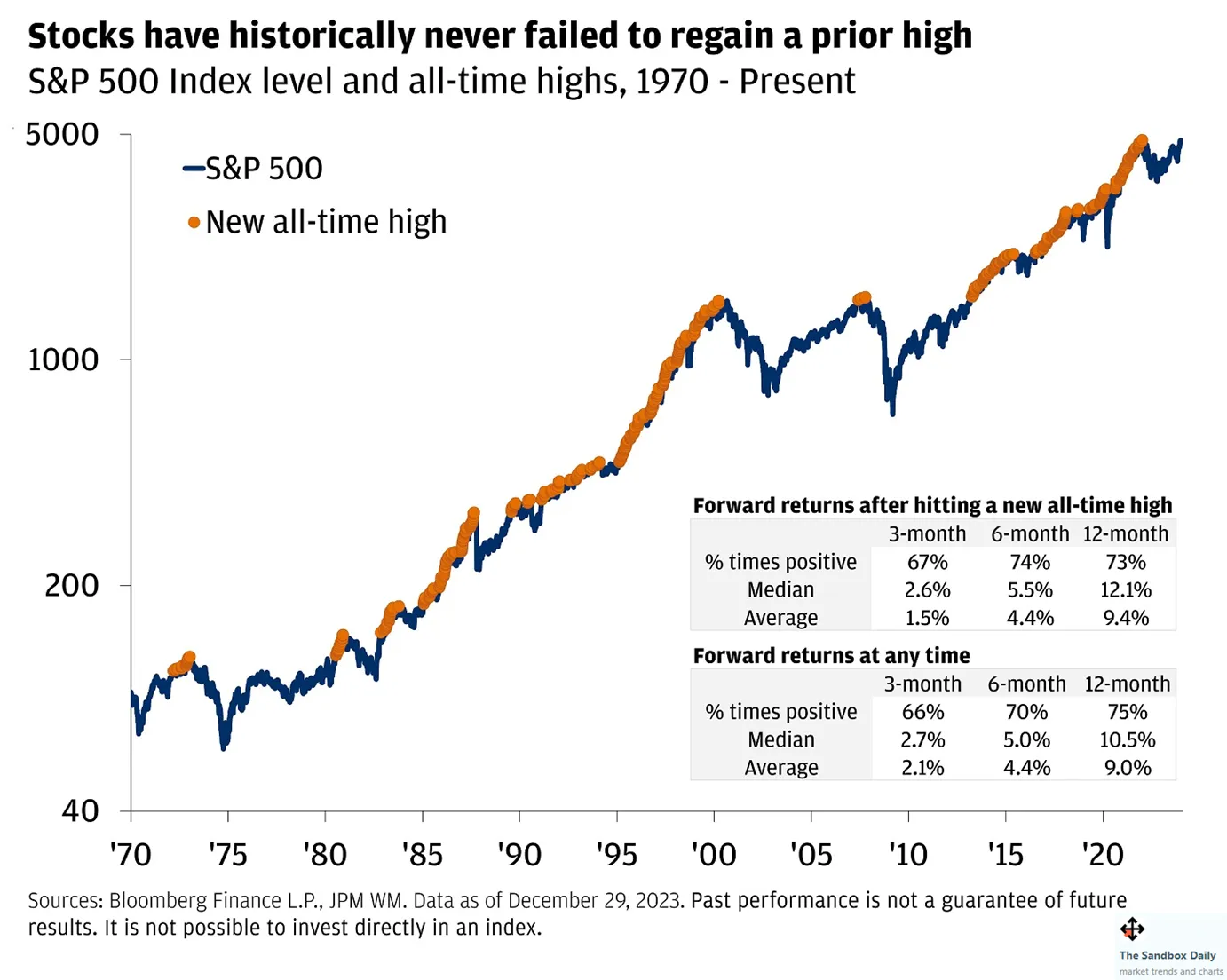

The stock market tests new highs and that’s not a bad thing. It’s easy to wring your hands about stocks being too expensive but as several articles point out: long term discipline can mitigate the impact of buying at the wrong time.

Not wrong

Finally, the cyber-attack that hit Change Healthcare might have been one of the worst in recent memory. While the victim reportedly paid the ransom, it’s likely that the recovery effort will take a long time. It’s bad, but keep in mind that Change’s parent unit, Optum Insight, only accounts for 12% of parent UnitedHealth’s overall earnings.

TOPICS

- Labor Market

- Global Recession

- Residential Real Estate

- Energy

- Stock Market Bubble

- Mergers and Acquisitions

- Cybersecurity

Labor Market

OBSERVATION - Nothing dramatic, outside of specific industries

- (Brief.News)

- U.S. Job Growth Misses Mark with 140,000 Added in February

- Slightly missing the expected 150,000.

- Job growth was led by trade, transportation, utilities, and construction, with professional and business services seeing job losses.

- The Labor Department’s upcoming employment report for February is projected to show gains of 160,000 private payroll jobs and 200,000 total nonfarm jobs with a steady unemployment rate of 3.7% and a slight decrease in annual wage growth.

- U.S. Job Growth Misses Mark with 140,000 Added in February

Global Recession

OBSERVATION - Weakness ahead, but is it recessionary?

- (Brief.News)

- Australia’s Economy Expands at Slowest Pace in Over a Year Amid Growth Concerns

- Grew by a modest 0.2% in the December quarter of 2023, the slowest in over a year.

- Annual GDP growth was 1.5%, slightly surpassing expectations

- Growth has been decelerating throughout 2023

- The Reserve Bank of Australia forecasts a dip in GDP growth to 1.3% by mid-2023, with a rebound to 1.8% by end of 2024.

OBSERVATION - Inflation trouble in the Mediterranean

- (Brief.News)

- Egypt Hikes Interest Rates by 6% to Tame Inflation, Pound Dives by Half

- The interest rate increase has resulted in the Egyptian pound’s value falling by nearly 50% compared to the US dollar.

- Egypt Hikes Interest Rates by 6% to Tame Inflation, Pound Dives by Half

Residential Real Estate

OBSERVATION - Some easing in rents

- (Calculated Risk)

- Apartment List: Asking Rent Growth -1% Year-over-year

- On a year-over-year basis, rents nationally are down 1 percent.

- After prices skyrocketed in 2021 and 2022, the pendulum has been swinging back a bit over the past year as price growth has been kept in check by sluggish demand colliding with a robust supply of new inventory hitting the market.

- Realtor.com: Sixth Consecutive Month with Year-over-year Decline in Rents

- Real Page: “Rent Growth Remains Near Stagnant”

- CoreLogic: “Single-family rental prices grew by 2.8% year over year”

- Apartment List: Asking Rent Growth -1% Year-over-year

Energy

OBSERVATION - Glut in natural gas means further energy security for the United States.

- (Doomberg)

- The price of natural gas in North America got so cheap that it was only a matter of time before something had to give.

- With front-month contracts recently trading for as low as $1.55 per million BTUs

- (energy equivalent price of less than $10 per barrel of oil)

- On Monday, the largest producer of natural gas in the US became the latest to yield, announcing a significant pullback from its near-term production plans

- Came on the heels of a similar move by Chesapeake Energy

- Posing the question as to whether the bottom is now in for one of the world’s largest and cheapest sources of hydrocarbon fuels

Stock Market Bubble

OPINION - Again, not wrong

- (Calculated Risk)

- The stock market is often trading at or near all-time highs with some regularity

- Over the last 50+ years, had you invested in the S&P 500 at an all-time high, your investment would have been higher a year later 73% of the time with a median return of 12.1%.

OPINION - Goofy graphic, but Keith isn’t wrong.

- (Keith Fitz-Gerald)

- “It’s better to be long than wrong”

- Two key takeaways should help alleviate any fear or uncertainty you may be feeling right now:

-

- There are a lot more bulls than bears over time.

-

- Investing in optimism beats cowering in fear every time, over time.

-

- The easiest way to do that is to buy world class companies that “put up the numbers” despite it all

Mergers and Acquisitions

OPINION - Macy’s is damaged goods

- (Seeking Alpha)

- Arkhouse Management and Brigade Capital Management offered to buy the Macy’s shares for $24 each, or $6.6 billion

- Group in December had offered $21 a share. The new bid is 33% higher than the closing price

- Stock had declined about 10% year-to-date through Friday.

- Arkhouse Management and Brigade Capital Management offered to buy the Macy’s shares for $24 each, or $6.6 billion

Cybersecurity

OPINION - Minor blip to a company as large as UnitedHealth

- (Seeking Alpha)

- UnitedHealth said to have paid ransomware group

- Allegedly paid $22M in bitcoin to a ransomware group to regain access to data and systems that were encrypted during a cyberattack on its Change Healthcare

- Change’s systems have been off-line since the cyberattack on Feb. 21

- On Tuesday, the American Hospital Association slammed UnitedHealth for not providing enough support to impacted hospitals and healthcare providers, many of which are running short on cash due to their inability to process claims and payments.

- Citi pointed out in its note on Tuesday that investors need to be reminded that UnitedHealth’s OptumInsight unit, which includes Change, is expected to only contribute around 12% of the company’s earnings for 2024.