2024 Week 2

Notes, thoughts and observations - Compiled weekly

Tech layoffs have taken the front page as three years of layoffs have far exceeded cuts demanded by simply over hiring. AI is often to blame, but the most likely candidate is the end of zero interest rate policy (ZIRP). Easy money will take time to unwind.

The stock market has already priced in rate cuts, but it is pure fantasy unless the domestic (US) economy takes a dive. Inflation has proven sticky, and analysts warn of a bumpy ride in the short term. However, an economic downturn might be near as coincident indicators point toward recession and consumer credit contracts. Nearly 30% Americans are behind on debt payments.

Meanwhile declining demand for oil indicate a global recession and slowing demand from China, and Middle East tensions. Likewise global shipping is under pressure and as it grows more difficult and dangerous, it also grows more expensive. Companies are looking to de-risk, and near shore nations like Mexico offer cheap manufacturing labor.

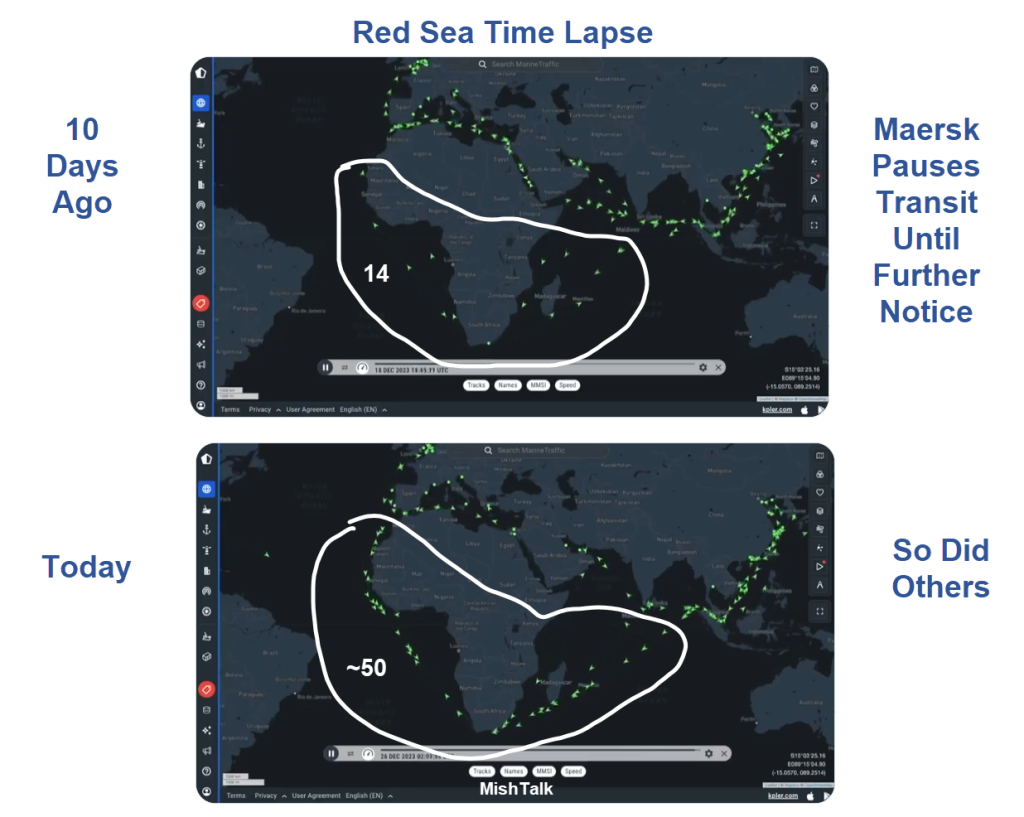

Red Sea Shipping Update, Maersk Pauses Transit Until Further Notice

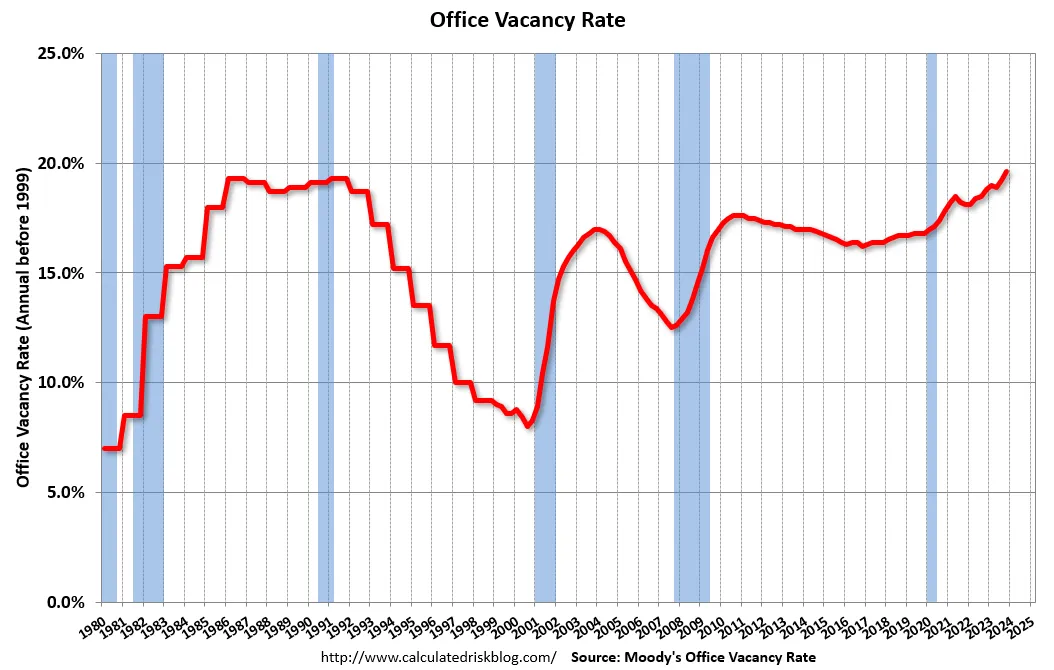

Less surprising is the headline that America’s corporate offices are emptier than at any point in at least 4 decades. Remote work, accelerated by the pandemic, has led to a staggering 19.6% of office space in major U.S. cities wasn’t leased. Companies are increasingly interested in smaller, more flexible spaces.

Finally, Gartner recently identified an interesting disruption that you may not have considered. Analysts are predicting a Golden Age of “Silver Workers” due to the talent crunch. The increased experience and productivity of seasoned workers coupled with the democratizes skills via AI could maximize elder workers’ value. The combination of retirement shortfalls and declining worker demographics could make this prediction a reality.

TOPICS

- Labor Market

- Consumer Credit Crunch

- Retirement Shortfalls

- Real Estate

- Energy

- Deleverage Globalization

Labor Market

OBSERVATION - Continued job reductions

- (Pragmatic Engineer)

- Why are layoffs coming hard and fast, again?

- unsurprising a large and unprofitable tech company is making deep cuts.

- What is unexpected is for profitable Big Tech companies to do this, almost exactly a year after other deep cuts: Amazon, Google, Meta

- We should brace for more tech companies announcing (or silently doing) layoffs throughout January.

- It is sensible to prepare for the possibility of cuts at your company.

OBSERVATION - Tech cutback

- (Brief.News)

- Twitch is laying off 500 employees, approximately 35% of its workforce.

- The layoffs respond to industry challenges including competition and controversy surrounding Twitch’s content and bans.

OBSERVATION - Tech layoffs have been massive; this take is a lot of spin.. saying tech will be replaced with AI. It might be what they say, but it’s not the truth. Tech over hired.

- (Peter St Onge)

- The tech sector shed over 168,000 jobs last year which actually matches the 2001.com layoffs

- It’s looking like 3 years in a row of Crash level layoffs in big Tech

- After Tech the most at risk Industries for layoffs were construction finance and insurance and Retail

- The tech sector shed over 168,000 jobs last year which actually matches the 2001.com layoffs

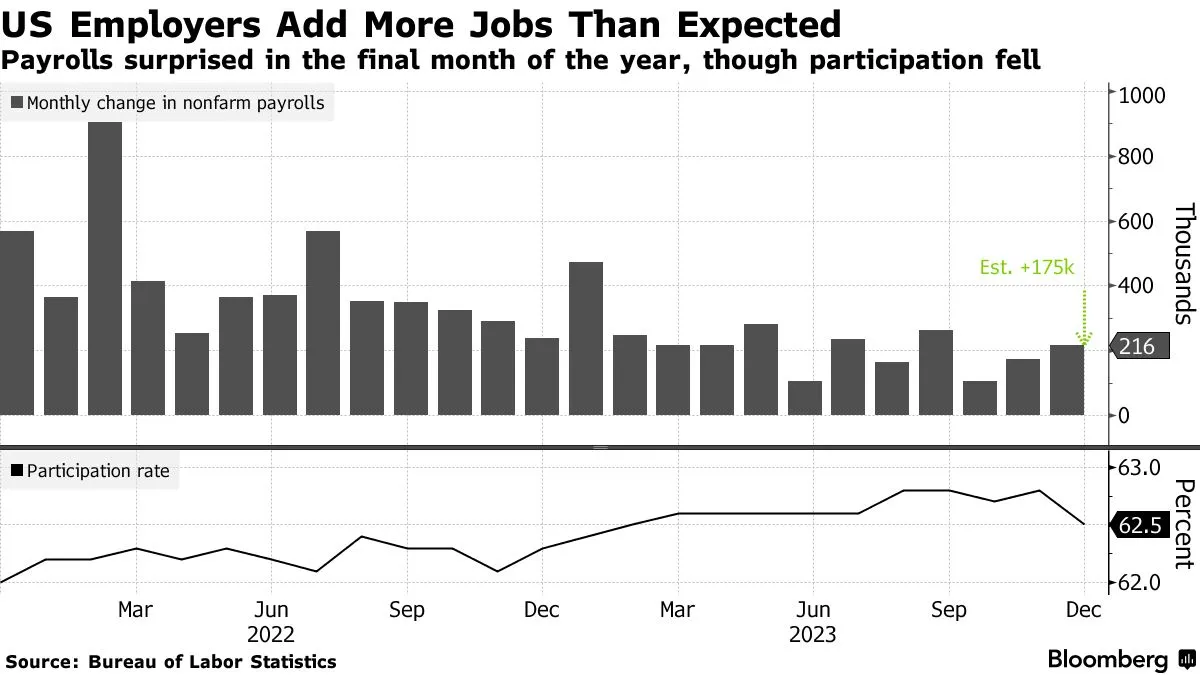

OPINION - Stocks pricing in rate cuts is pure fantasy. Labor is weak, but inflation is sticky. Brace for a bumpy ride (short-term)

- (Sandbox Daily)

- Solid job growth, but with less rosy details

- The labor market ended 2023 on solid ground, with nonfarm payrolls expanding by 216K in December which was above consensus of 170K and the highest print in 3 months.

- The U.S. economy has now added jobs for 36 consecutive months.

- Average hourly earnings jumped +0.4% MoM, pushing the YoY change up to +4.1%. This is good news from the perspective of the consumer who are now making gains in real terms as inflationary pressures continue to subside.

- Puts more pressure on the Fed to maintain their higher-for-longer message – not good for stocks

- The unemployment rate remains at 3.7%; economy remains at/above full employment.

- Jobs data for the prior two months (Oct & Nov) were revised down by 71K.

- It’s estimated ~25% of the job gains made in 2023 have ultimately been revised away.

- This month, government payrolls rose by a solid 52K

- Government has been providing an offset to slower job growth or job cuts in cyclical sectors

- The labor force participation rate slumped from 62.8% to 62.5%

- 676K people left the labor force – the largest monthly drop in nearly 3 years.

- Job growth averaged 165K in the fourth quarter, the weakest quarter of the expansion

- March rate cut seems premature, although the market is still assigning at least a 60% probability of that happening.

- Solid job growth, but with less rosy details

OBSERVATION - Cyclical hiring seems to have ceased

- (Over My Shoulder)

- December payrolls rose more than expected, according to today’s release, but the longer-term trends continue to weaken.

- A large drop in the labor force kept the unemployment rate at 3.7%.

- A reduction in hours worked points to lower labor demand but employer reluctance to shed hard-to-find workers.

- Bottom Line: Job growth is increasingly concentrated in non-cyclical sectors like government and healthcare.

Consumer Credit Crunch

OBSERVATION - Spending running out of steam, at the bottom

- (Lending Tree)

- Nearly 30% of Americans in 100 Largest Metros Are Behind on Debt Payments

- 29.6% of Americans in the 100 largest metros were behind on their debt payments between July 1 and Sept. 30, 2023.

- Southern residents are particularly likely to be behind on a payment

- 27.3% of consumers across the 100 metros have debt that’s seriously delinquent (overdue by 90 days or more), while 26.2% have debt in collections

- By debt type, Greensboro, N.C., has the highest percentage of consumers behind on credit card payments (26.8%).

- Over one-third of millennials (36.7%) and Gen Zers (36.2%) are late on at least one account payment.

- Nearly 30% of Americans in 100 Largest Metros Are Behind on Debt Payments

Retirement Shortfalls

OBSERVATION - AI and flexible work could make this possible

- (Gartner)

- 7 Disruptions You Might Not See Coming: 2023-2028

- Golden Age of “Silver Workers”

- Talent crunch: increased experience, salary equity

- AI democratizes skills

- Elder workers’ value is greater

- *TAKEAWAY: Orient compensation to incent older workers, experiment with part-time work, flexible hours

- 7 Disruptions You Might Not See Coming: 2023-2028

Real Estate

OBSERVATION - Predictable outcome

- (Blake Millard)

- America’s corporate offices are more empty than at any point in at least 4 decades

- Years of overbuilding

- Cheap credit

- Shifting work habits that were accelerated by the pandemic

- Hit a record high in the 4th quarter of 2023, surpassing previous peaks last reached in 1991 and 1986.

- A staggering 19.6% of office space in major U.S. cities wasn’t leased, up from 18.8% a year earlier.

- Companies are eager to cut costs; dump aging office parks built in the 1980s

- America’s corporate offices are more empty than at any point in at least 4 decades

OBSERVATION - Trend is smaller, more flexible space; Office loans due/rollover in next 2 years

- (Bill McBride)

- Moody’s: Apartment Vacancy Rate increased in Q4; Office Vacancy Rate in “Uncharted Territory” at Record High

- National apartment vacancy rate went up 20 basis points (bps) to 5.4%

- For multifamily, 1 in every 5 metros have recorded over 2% of inventory growth in 2023 while nearly 60% (47 of 79) of primary metros had more move-outs than move-ins in the last quarter of the year.

- Office Vacancy Rate Approaching S&L Crisis High

- Vacancy rate rose 40 bps to a record-breaking 19.6%

- New Class A properties which offer flexible or smaller configurations are particularly attractive to tenants who decided to keep the physical office footprint for branding, purposeful gathering, training, and collaboration purposes.

- The largest office loans coming due soon looms, especially those carrying a debt yield less than 8%, having significant lease rollover in the next two years, and/or facing single-tenant exposure.

Energy

OBSERVATION - Declining demand indicate a global recession

- (Brief)

- Saudi Arabia Slashes Oil Prices Amid Rising Supply and Geopolitical Tensions

- The move is in response to increased supplies from non-OPEC+ countries, slowing demand from China, and Middle East tensions

- Oil prices have fallen with Brent crude and crude oil down 1.12% and 1.19% respectively

Deleverage Globalization

OPINION - Investors starting to pick up on the trend

- (Ed D’Agostino)

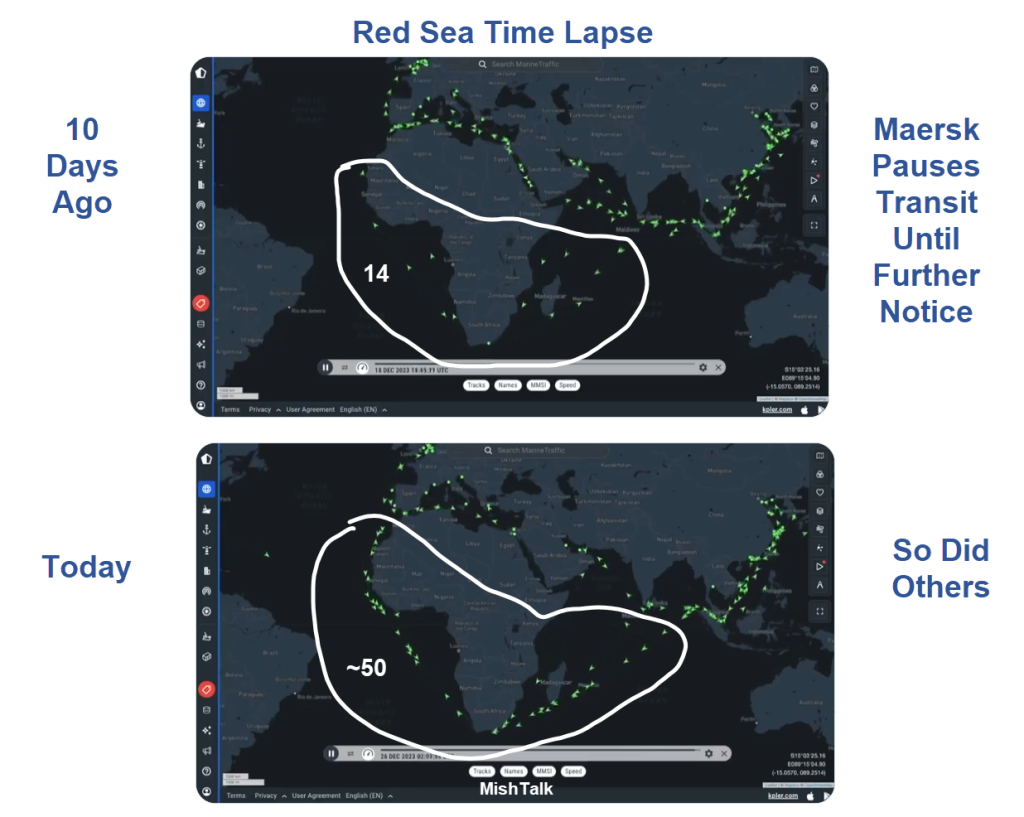

- Global shipping is under pressure.

- Houthis are disrupting shipping through the Suez Canal, a critical artery for ships traveling between the Middle East and Europe.

- Around 30% of global container traffic flows through the Suez Canal.

- As global shipping grows more difficult and dangerous, it also grows more expensive.

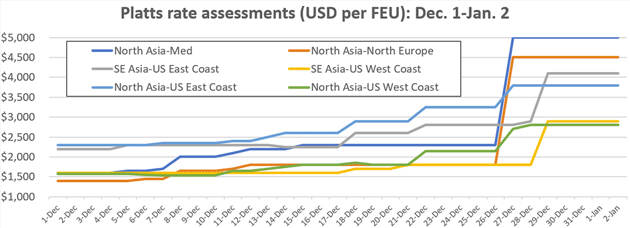

- Shipping rates for the North Asia-Mediterranean route had more than tripled since early December.

- Unfortunately, today’s level of global tension could be our new baseline. That is contributing to a realignment of global trade patterns.

- Companies are looking to de-risk. And for US companies, that often means reshoring and nearshoring production.

- Pandemic-era supply disruptions accelerated it,

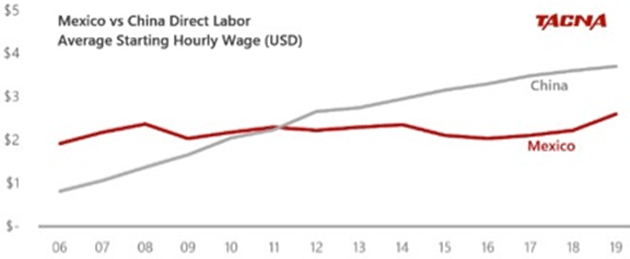

- China much more expensive in recent years.

- Mexico now offers the second-cheapest manufacturing labor in the world.

- Helps that you don’t need to move things made in Mexico via ship.

- Earlier this year, Mexico became the top US trading partner. Canada comes in at number two.

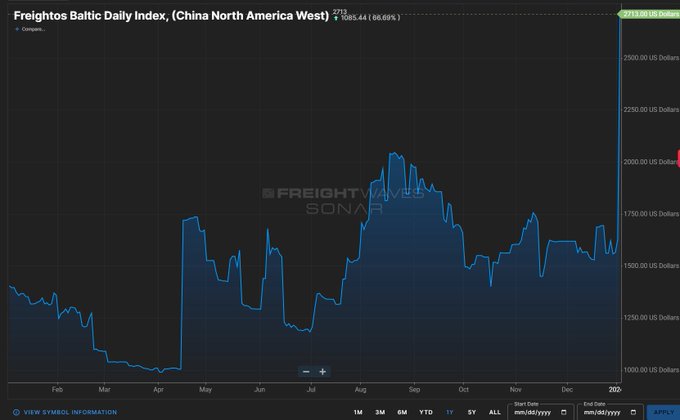

OPINION - Short term might drive inflation, long term unwind globalization

- (LukeFalasca)

- Container shipping rates from China to US West Coast are finally seeing an impact from the Red Sea crisis as shipping rates on this trade lane hit a 1-year high!

OBSERVATION - Visible evidence of the disruption

- (Mike Shedlock)

- Red Sea Shipping Update, Maersk Pauses Transit Until Further Notice

OPINION - Impact will be felt in Europe, important for the US to protect allied shipping lines

- (Seeking Alpha)

- Shipping giant A.P. Moller-Maersk (OTCPK:AMKBY) has halted all transit through the Red Sea and the Suez Canal after a weekend attack on one of its ships.

- There have been 24 attacks against merchant shipping in the Southern Red Sea since Nov. 19, according to the U.S. Central Command.

- Following rival Hapag-Lloyd (OTCPK:HLAGF) (OTCPK:HPGLY) in continuing to reroute its vessels.

- Some vessels will be rerouted around the Cape of Good Hope in South Africa.

OBSERVATION - Keep an eye on this sentiment as the European Union starts to fall apart as Germany unravels.

- (Clips That Matter)

- In 2016, the UK held a referendum on leaving the European Union, which passed with about 52% support.

- Survey data says it would probably fail today