2023 Week 50

Notes, thoughts and observations - Compiled weekly

Last update for the year. The labor market remains resilient but areas such as physical entertainment are struggling against an expanding landscape of digital entertainment. JOLTS data indicates employment decline in several sectors, but information remains unscathed.

A reminder that a lifetime guarantee is only as good as the company. Even though the classic indicator of recession remains in place many are starting to believe in economic soft landing. Call it a mild recession or not, the FED has signaled rate cuts are ahead.

Finally commercial real estate is still on everyone’s mind. In my local market of Charlotte, NC many uptown towers remain partially empty. Some predict it could be years before occupancy rates recover. Meanwhile many new businesses are increasingly likely to start remote which will impact everything from small offices to office supply and equipment purchases.

With that here are my last business notes of the year. Have a happy season and we will see you in 2024.

Classic recession indicator remains in place

TOPICS

Labor Market

OBSERVATION - Shake out as digital replaces physical entertainment with youth.

- (Providence Journal)

- Hasbro to close Providence office, layoff 1,100 people in the next year

- To close Providence office, consolidate in Pawtucket

- Six-story Providence office, on Fountain and Sabin streets across from the Amica Mutual Pavilion, will be vacated by January 2025, when the lease ends

- In late October, Hasbro and rival toymaker Mattel warned of slow sales going into the holiday shopping season.

OBSERVATION - What does it mean? What do JOLTS really mean?

- (Seeking Alpha)

- Job openings unexpectedly fall in October, quits rate stays at 2.3% - JOLTS report

- Declined to 8.733M in October from 9.350M in September

- Job openings decreased in:

- health care and social assistance (-236K)

- finance and insurance (-168K),

- real estate and leasing (-49K).

- Job openings increased in information (+39K).

- Layoffs and discharges rose slightly to 1.642M from 1.610M in September

Bankruptcy

OBSERVATION - Lifetime Guarantee only last as long as the company

- (APNews)

- SmileDirectClub shuts down months after filing for Chapter 11 bankruptcy protection

- Aligner treatment through its telehealth platform is no longer available

- Customer orders that haven’t shipped yet have been canceled and “Lifetime Smile Guarantee” no longer exists

- “SmileDirectClub apologized for the inconvenience”

Recession

Classic recession indicator remains in place

- (Blake Millard) ::

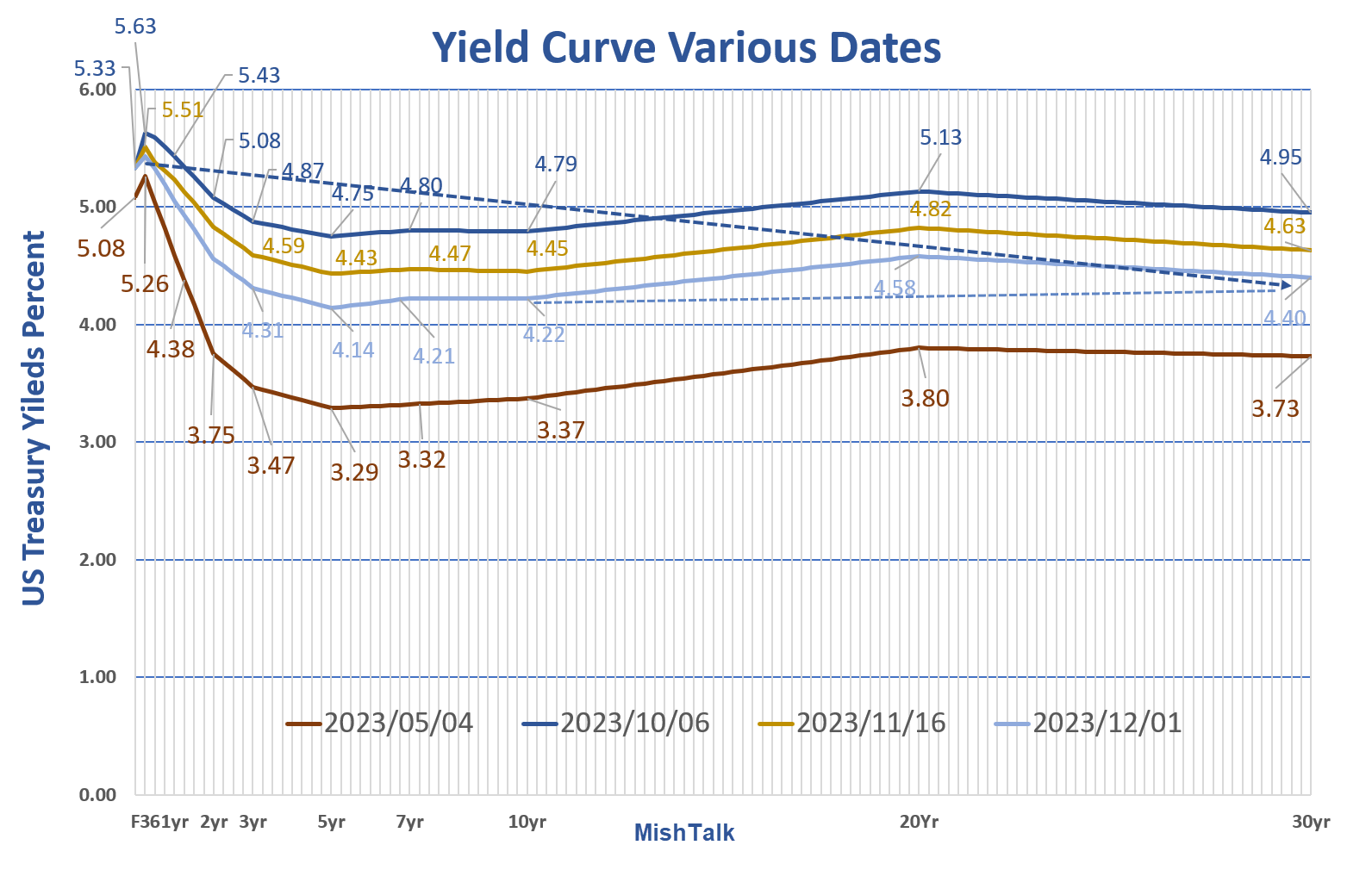

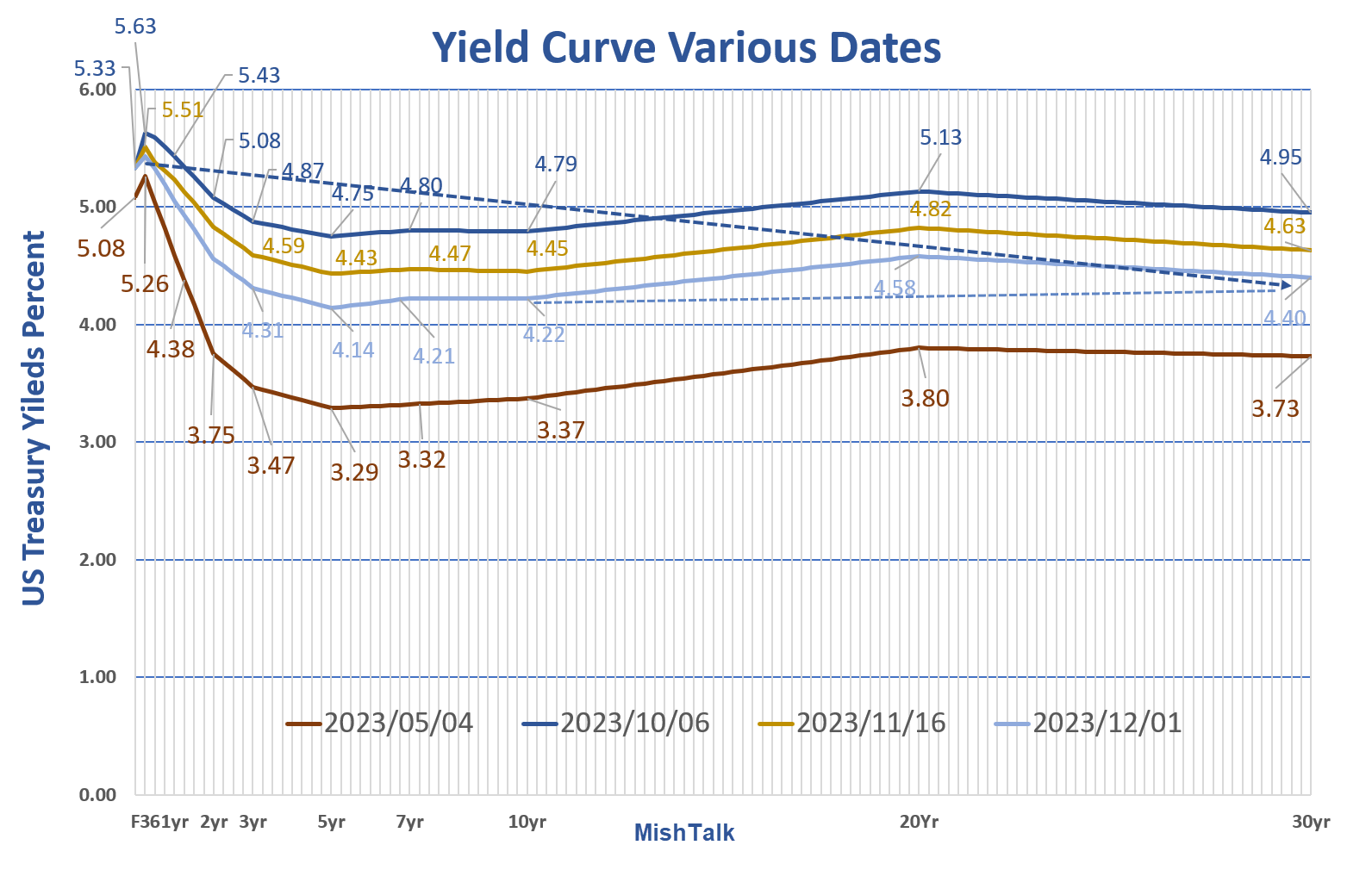

- The U.S. Treasury yield curve from the last three years that shows the evolution of the current monetary policy cycle, as well as the broader range of interest rates over the last 15 years (grey shade block

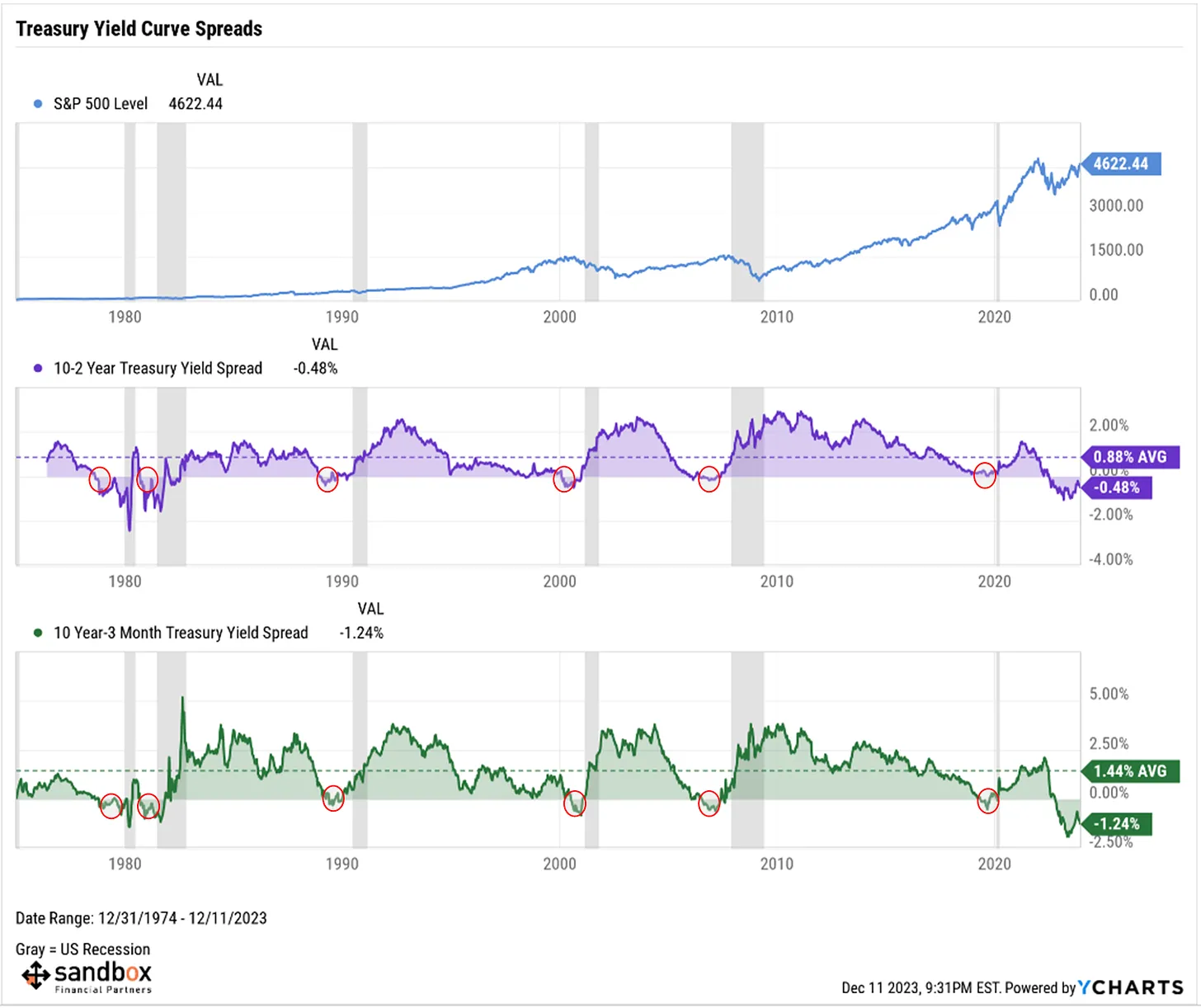

- Over the past 50 years, the curve has inverted 6 times and 6 recessions followed – this signal never generated a false positive (red bubbles below).

OPINION - I think “a short quick recession followed by a big inflation problem coming down the pike” is the most likely reason

- (Mike Shedlock)

- Smoothed Chart Removing Second Hump

- The darker dashed blue line shows we are not dealing with a normal inversion. Starting at 5 years the curve steepens.

- I suspect illiquidity of the 20-year bond explains the nature of the curve between 10 years and 30 years. So, mentally smooth it out with that as I did above.

- Three Possible Explanations

- Regarding the huge inversion between 1 month and five years, then strongly steepening: Could it be the bond market smells a short quick recession followed by a big inflation problem coming down the pike?

- Risk aversion: Risk aversion is another possibility. Investors are happy with shorter term bonds and demand increasing more out of justifiable fear of what might happen.

- What about the fed? Does the market finally understand the Fed is no longer in control?

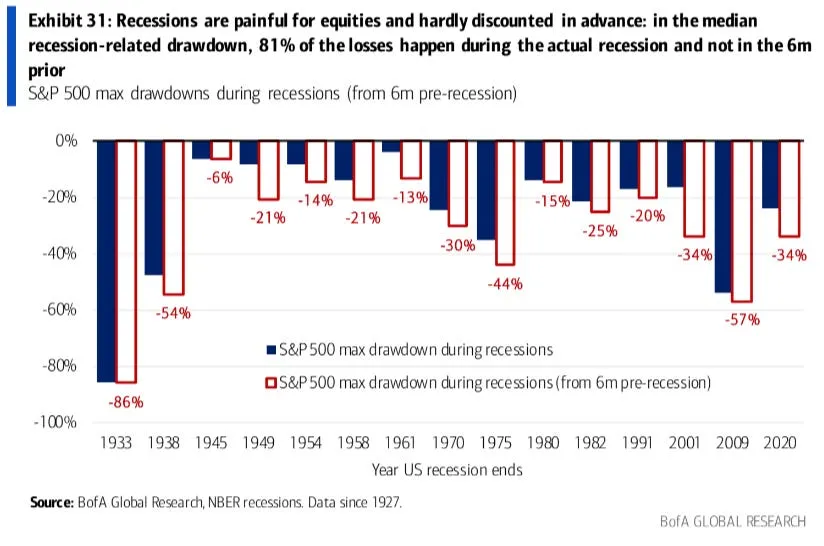

OBSERVATION - So how do you explain the market downturn we just came through.. dare I say “recession”?

- (ChartStorm)

- This chart shows the drawdown in equities during recession (the dark blue bars) vs the drawdown including the time period 6-months prior to recession. For the most part the bars are fairly close together… or in other words, most of the pain comes during recession.

Real Estate

OPINION - I don’t think this is the end of the office, but maybe the large uptown tower.

- (Charlotte Ledger)

- ‘There’s going to be pain,’ expert says as some uptown towers remain empty amid nation-leading delinquency rates.

- It’s been a little more than two years since Charlotte’s largest companies started bringing employees in sectors like law, tech and finance back to in-person work. Many are now regularly at the office at least part of the time.

- But a shift away from the office appears to be permanent. In uptown, the office vacancy rate has more than doubled since 2019 and some towers sit mostly empty. Across the city, older buildings are struggling to find tenants.