2023 Week 35

Notes, thoughts and observations - Compiled weekly

Real estate is in a weird place right now with apartments asking rents on the decline and vacancy rates near pre-pandemic levels. On the flip side residential housing inventory is at the lowest level in history. My suspicion is that forces are still distorting the market as the smallest generation in American history nears homebuying age.

Meanwhile credit availability is declining, and debt service payments are climbing along with interest rates. All these things will put pressure on consumers to continue spending, especially now that they’ve burned through pandemic savings and windfall.

I add EVs to the list of “too good to last” as buyers start to realize that Tesla cars are popular not because they are electric, but because they are technology platforms. In that regard Tesla is miles ahead of the competition and even the Ford CEO admits that investing deeply into electric vehicles might have been a mistake.

Finally, I close with thoughts of China and global recession. While you can ascribe any number of reasons to what China is experiencing the underlying cause is nothing unexpected. China is no longer the lowest cost manufacturer and on top of that the central government drastically overbuilt both industrial and residential assets. It will take years to unwind. The fall out, I fear, is an Asia driven global recession that hits everyone else in the next 12-24 months.

TOPICS

Real Estate

OBSERVATION - Rent rates and vacancy tells a very contrary story to residential real estate

- (Calculated Risk)

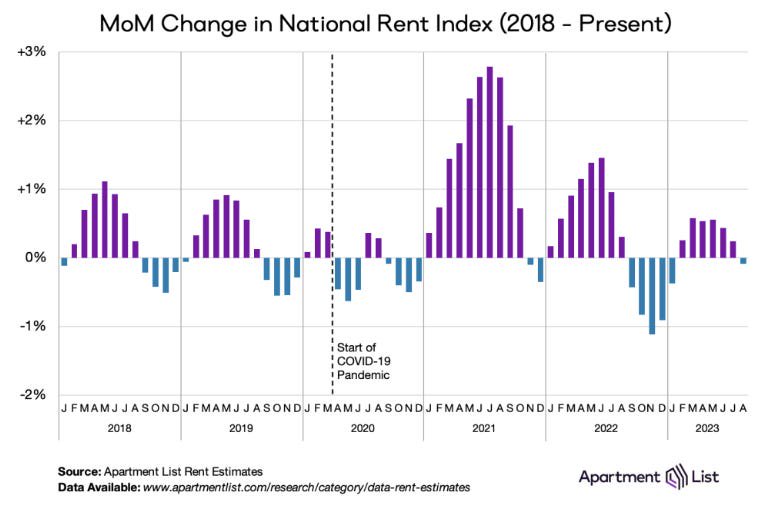

- Apartment List: Asking Rent Growth -1.2% Year-over-year

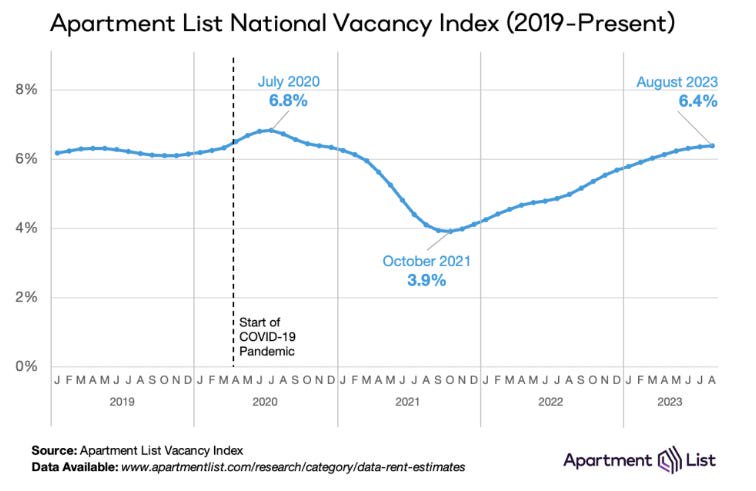

- Our vacancy index has increased for 22 consecutive months and now sits at 6.4 percent, slightly above the pre-pandemic average.

OBSERVATION - And production (homebuilding) is maxed out

- (KobeissiLetter)

- Housing inventory is now at its lowest point in history.

- In the US, there are a total of 950,000 single family homes for sale.

- To put this in perspective, there were 3.5 MILLION single family homes in 2008.

- That’s nearly 4x as many houses that are for sale today.

- In 1987, there were ~3x the number of houses that are fore sale today. However, since 1987 the US population has jumped by ~40%.

- This is the product of rapidly rising rates with many people locked-in to 3% mortgages.

- Why sell if your mortgage rate doubles?

- Housing inventory is now at its lowest point in history.

OPINION - Voting with your feet is a long term trend in real estate

- (NewsLambert)

- Strong in-migration continues in: Houston Jacksonville Charlotte San Antonio Fort Worth Nashville

- Very negative domestic out-migration continues in: East Bay Area Orange County San Diego San Jose Miami DC Boston Chicago San Francisco

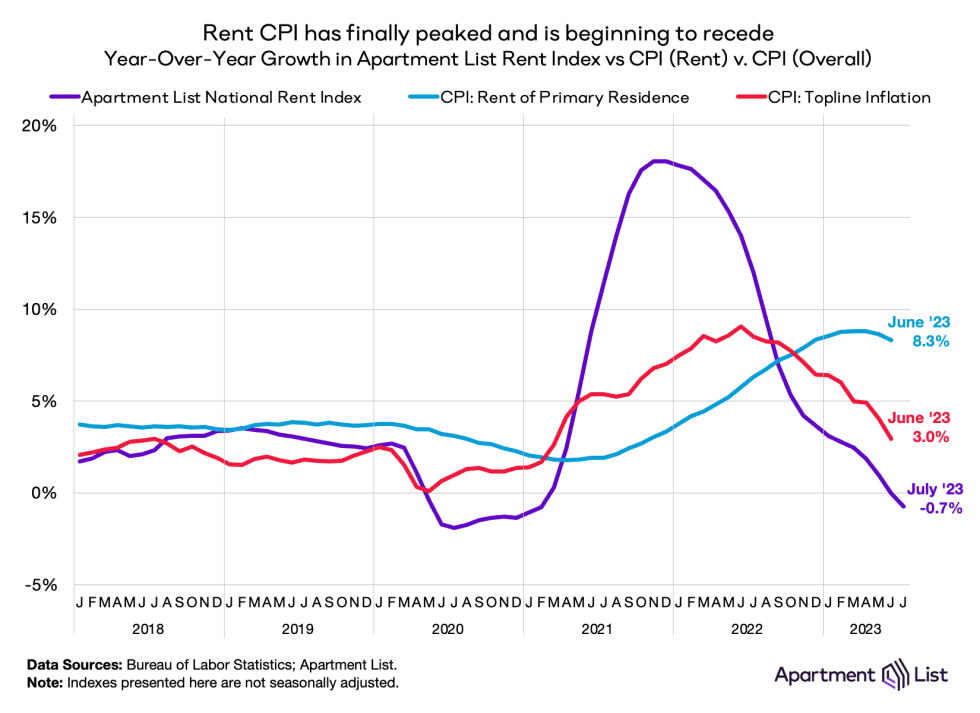

- 8/25/2023 (Barry Ritholtz) :: OBSERVATION - Apartment rentals rates go negative

- The rental market slowdown is finally reflected in inflation numbers

Debt

OBSERVATION - I am increasingly concerned about the overall impact of credit and interest rates on EVERYTHING.

- (Over My Shoulder)

- Into the Contamination

- The price of credit is rising faster than goods and services prices, giving us this strange kind of inflation.

- New bank regulations are proving costly and may force credit downgrades on many large, seemingly stable institutions.

- Grant expects to soon see 6% or higher rates across the whole yield curve.

- This will affect not just government but also credit-sensitive businesses, where profits may fall as borrowing costs rise.

- Into the Contamination

Automotive

OPINION - EV’s are going to wreck dealers in an already weak automotive retail market.

- (tylerdurdenzbro)

- I have three different friends who own car dealerships in TX, Ford, GM and Cadillac and another in GA that is a Mercedes dealer. Unanimously they are being forced with over supply of EV’s that they can’t sell, and finite supply of what sells (ie Ford F-150).

- They are all taking losses to get rid of the EV supply and cannot keep a single high demand (all gas or diesel powered cars, trucks and SUVs) on the lot. They are all on back order. Everyone I know is having to go to dealers that are not subject to pricing restrictions to buy

Recession

OPINION - Cool chart, but I think the trend is less about autocracies and more about China being played out as an emerging market.

- (RobinBrooksIIF)

- The change in global capital flows is seismic. For the past decade, China (red) attracted the bulk of capital flows to EM, often at the expense of other BRICS. But China has now seen consistent and large outflows for the past 18 months, as investors grow wary of autocracies…