Category:

Business

2023 Week 34

Notes, thoughts and observations - Compiled weekly

Housing affordability is at it’s lowest in a long time, and as such I think things are about to slow down dramatically in the residential real estate market.

Further a consumer credit crunch is starting to hit consumers as household savings are exhausted and interest rates continue to rise.

Meanwhile everyone has predicted China’s demise for a long time. Economic reality is setting in, and while it will take a long time for the country to muddle through not only the excesses, but the shifting demographic picture as well.

TOPICS

Real Estate

PREDICTION - Things are about to really slow down in residential real estate

- (Sandbox Daily) ::

- Housing affordability is becoming a real issue.

- The average 30-year fixed-rate mortgage rose to 7.09% this week – its highest level in more than 20 years

- What does that mean? In 2020, a person could afford a $758k house with 20% down on a $2,500/month 30-year mortgage.

- Now, for the same money down (20%) and targeting that same monthly payment of $2,500/month, the most a person can afford is a $443k home purchase.

Credit Crunch

OPINION - “Sticky” inflation is an added tax on households, and wages aren’t (and can never) keep up

- (Sandbox Daily)

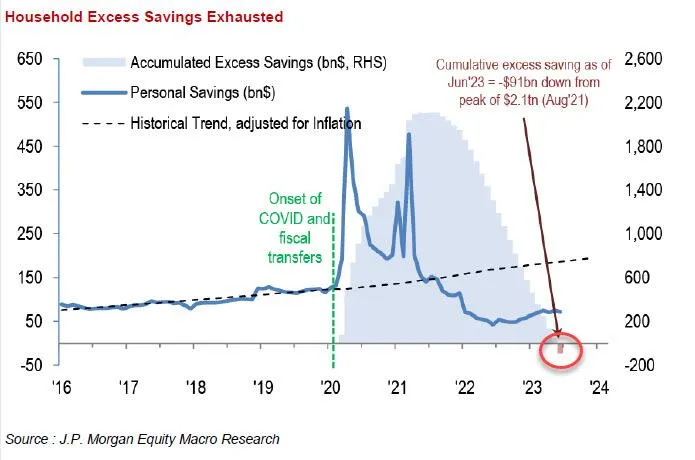

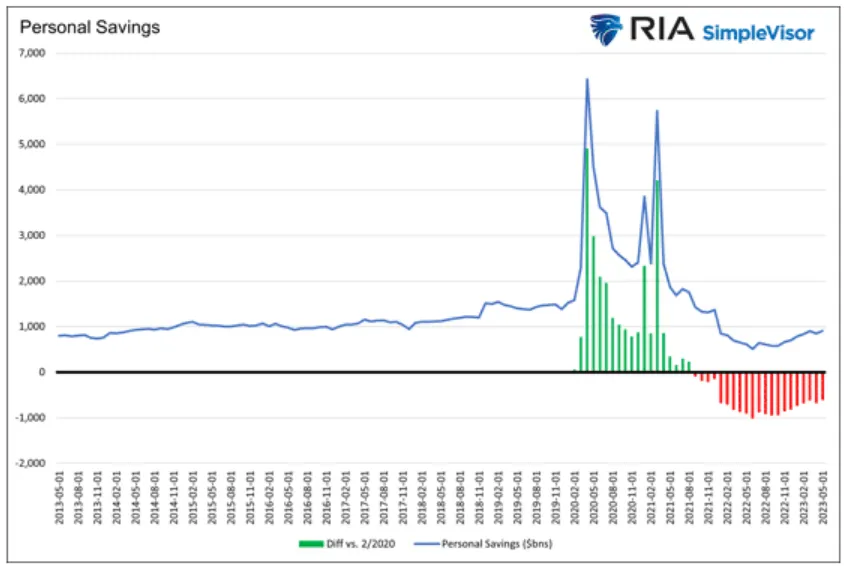

- Household Savings Exhausted

- Since 2020, corporations and individuals were provided significant funds from the federal government to combat the pandemic-related economic shutdown

- Many measures had cumulative excess savings peaking around $2.1 trillion dollars back in the summer of 2021.

- A troubling trend is emerging in that the amount households save on a monthly basis is now less than pre-pandemic.

- With higher prices across the economy, revenge travel and spending, things like concerts and games back to normal, lower savings rates, and the rest, one would expect excess savings to have drawn down.

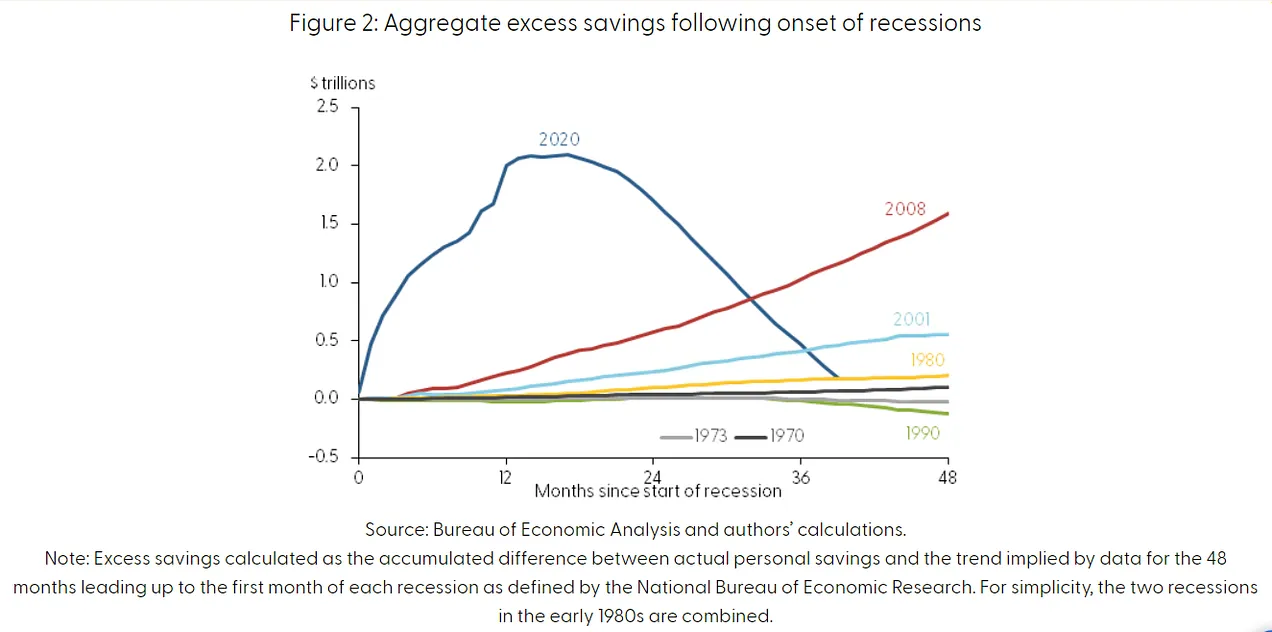

- The rapid accumulation and subsequent depletion of excess savings during the current cycle moved at a much quicker pace than prior period.

- With excess savings nearly exhausted, one key tailwind for consumer spending that boosted the U.S. economy over the last year or two seems to be fading away.

- Household Savings Exhausted

Recession

OBSERVATION - Those in the know have been calling this for a while, no doubt demographic and politics will make for a long recovery.

- (Over My Shoulder)

- Why China’s Economy Ran Off the Rails

- For decades, China reaped huge productivity gains by liberalizing pieces of its state-controlled economy.

- After the 2008 financial crisis, Chinese leaders pivoted from exports to real estate. This avoided recession but had unintended negative consequences.

- BOTTOM LINE : China seems to be going through a period much like 1990s Japan or the post-2008 US. Those were rough but both countries finally recovered. The difference is China’s authoritarian politics may make the process worse, with global implications in everything from energy to currencies.

- Why China’s Economy Ran Off the Rails