Category:

Business

2023 Week 6

Notes, thoughts and observations - Compiled weekly

TOPICS

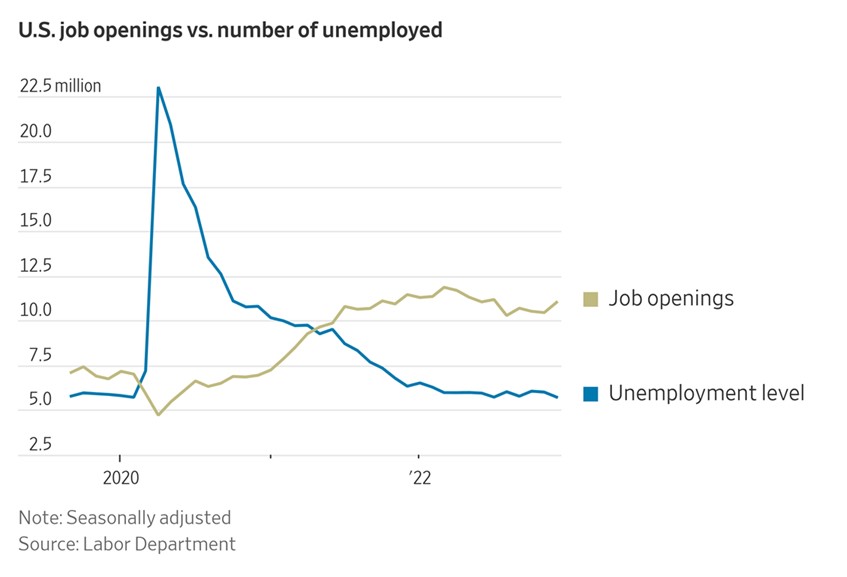

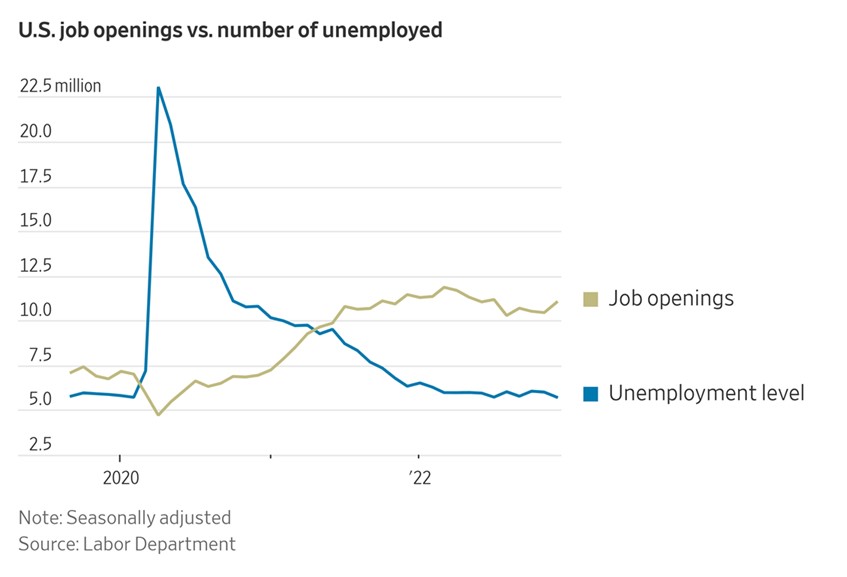

Job openings are 1.9 times larger than the number of unemployed workers

Labor Market

OBSERVATION - Wage pressure continues

- (Seeking Alpha)

- Delta to implement second pay hike in 12 months

- Delta Air Lines (NYSE:DAL) announced on Tuesday a 5% pay increase for eligible employees with effect from April 1, 2023. This marks the second pay increase in the last 12 months, with a total 9% hike.

- The pay increase applies to employees across the board, including flight attendants and ground employees, not otherwise covered by an industry, government, or collective bargaining agreement.

- Delta to implement second pay hike in 12 months

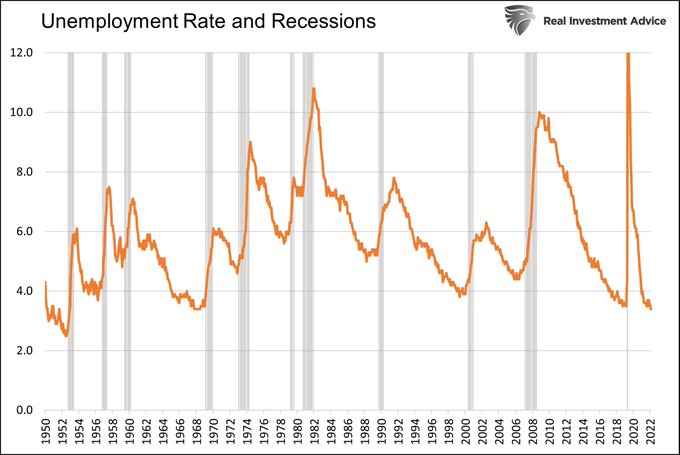

TAKEAWAY - Layoffs ahead, but not to the degree of 2008

- (michaellebowitz)

- “You don’t have a recession when you have the lowest unemployment rate in 53 years.” - Janet Yellen

- 100% false.

- “You don’t have a recession when you have the lowest unemployment rate in 53 years.” - Janet Yellen

- (elerianm)

- Per this @WSJ chart using @BLS_gov data, US job openings are 1.9 times larger than the number of unemployed workers (11.0 versus 5.5 million).

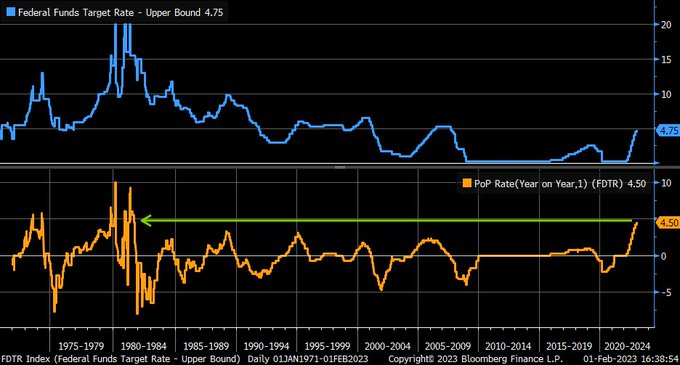

Fed Rate

TAKEAWAY - Long term a spiral of high deficits, high debts, and high interest rates will create structural inflation and money supply growth.

-

(LynAldenContact) - My latest article discusses the switchover from the Fed operating at a profit to operating at a loss, the subsequent elimination of remittances to the Treasury, and what implications this can have. How the Fed “Went Broke”

- The U.S. Federal Reserve is now operating at a financial loss, and is months away from having negative tangible equity for the first time in modern history.

-

- Fed’s 25bps rate hike yesterday brings year/year rate of change to 4.5%, which is fastest since 1981

Recession

QUESTION - 2023 could be the pause that refreshes… before a much worse 2024.

-

- “My calculations of trendline value of the S&P 500, adjusted upwards for trendline growth and for expected inflation, is about 3200 by the end of 2023. - Jeremy Grantham

- “Other factors suggesting a long or delayed decline include the fact that we start today with a still very strong labor market, inflation apparently beginning to subside, and China hopefully regrouping from a strict lockdown phase that has badly interfered with both their domestic and international business… - Jeremy Grantham

- but most analysts put the peak of excess savings at $2‒3 trillion in late 2021. This excess savings balance has been slowly drawn down over the course of 2022, but less than half now remains. Once it runs out, by some estimates around mid-year, this particular support for the economy will be gone.” - Jeremy Grantham

- Further to that point, markets usually don’t bottom until 7‒8 months after a recession starts, which hasn’t officially happened yet. - John Mauldin

- I believe the Fed is going to keep rates high(er) for some time and continue quantitative tightening as assets roll off the balance sheet. There will be no rate cuts this year, barring some really serious event. - John Mauldin

-

(mishgea) ::

- All of this still fits my overall thesis in place for a year now: Recession sooner rather than later but with a minimal rise in the unemployment rate. I know of no one else who has held that view.

Environment

OPINION - Topic reemerges once a month, eventually someone will take decisive action that will have catastropic impact to someone else’s local economy

- (peterzeihan)

- We are very close to upstream states simply abrogating the compact and taking water that by treaty “belongs” to California. The real question is whether or not Colorado acts unilaterally, or a group of states does so together.

- ‘Dead pool’ approaches: Western water crisis looms as California complicates critical water deal