Category:

Business

2022 Week 38

Notes, thoughts and observations - Compiled weekly

THIS WEEK

Bankruptcies

Inflation feels good at first but the endgame is grim - Jens O. Parsson

- (Seeking Alpha) :: Carvana: Bankruptcy May Be Inevitable

- The used car market boomed over the past two years as new vehicle production declined and economic stimulus increased vehicle demand.

- Today, economic demand appears to be retracting while new vehicle production normalizes, creating immense negative strain on used car prices.

- Carvana faces this shift with high inventory, rapidly growing financial debt, and declining gross margins.

- Carvana’s business model looks great in theory, but I do not believe it can generate profits - particularly with interest costs rising.

- In my view, Carvana is likely to go bankrupt but may not be a short opportunity due to its high squeeze risk.

- Various factors promote the “auto recession,” including renewed supply growth, high vehicle prices, higher financing costs, falling real wages, low personal savings, and poor consumer sentiment. The auto industry is highly cyclical, so its bust should not be surprising given its recent boom.

- Carvana is not likely to survive this bust. To earn a consistent profit, Carvana must sell vehicles at a higher price than it purchased

- Last quarter, Carvana posted a larger earnings loss of $238M but had a positive operating cash flow due to declines in inventory.

OPINION :: Used vehicle sales will decline, and it will put extreme pressure on used car sales services

Labor Market

Maintain austerity in good times to avoid layoffs in bad times. - Carlos Slim

- (Morning Dispatch) :: COVID-19 reduced the U.S. workforce by 500,000

- A working paper released Monday by the National Bureau of Economic Research suggests COVID-19 illnesses have reduced the U.S. workforce by about 500,000 people.

- Researchers from Stanford University and the Massachusetts Institute of Technology found that employees who missed a week of work for COVID-19 were 7 percentage points less likely than employees who didn’t to still be in the labor force a year later, suggesting the long-term health effects of an infection are inhibiting some people’s return to work.

OBSERVATION :: 1/2 million fewer workers contributed to the scarcity, we can’t ignore that

Real Estate

Location, location, location

- (Calculated Risk) :: Inventory growth has stalled recently as new listings have declined year-over-yearly changes in the housing market:

- New listings have declined significantly year-over-year.

- This “Sellers’ Strike” has led to inventory growth stalling.

- And homeowners have continued to borrow against their home equity, shifting from cash-out refinance to home equity loans (so they can keep their low interest 1st mortgage).

OPINION :: Slowing real estate market will decrease the consumer wealth effect, which will reduce broader demand

Credit

Buy Now, Pay Later - Just a fancy word for credit, and we know how this ends

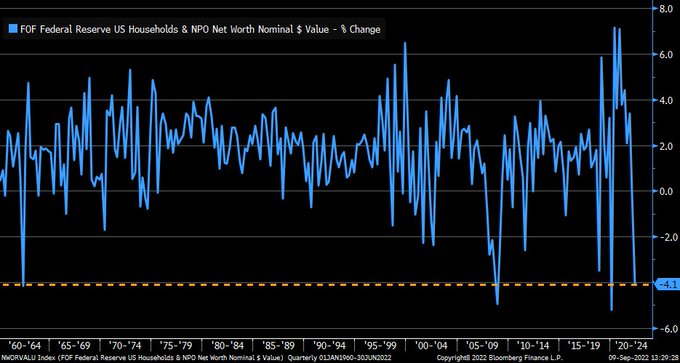

- (LizAnnSonders) :: U.S. household net worth fell in 2Q22 by $6.1 trillion; steeper drop than $143.8 billion lost in 1Q22 and $6.07 trillion lost in depths of pandemic (1Q20) … in % terms (shown in chart), -4.1% drop was among worst on record

- (unusual_whales) :: The weakest American borrowers are starting to miss payments and default on their loans at Goldman’s Sach’s, $GS, loss rate on credit card loans being the worst among big U.S. card issuers and “well above subprime lenders” at 2.93%, per CNBC.