2024 Week 8

Notes, thoughts and observations - Compiled weekly

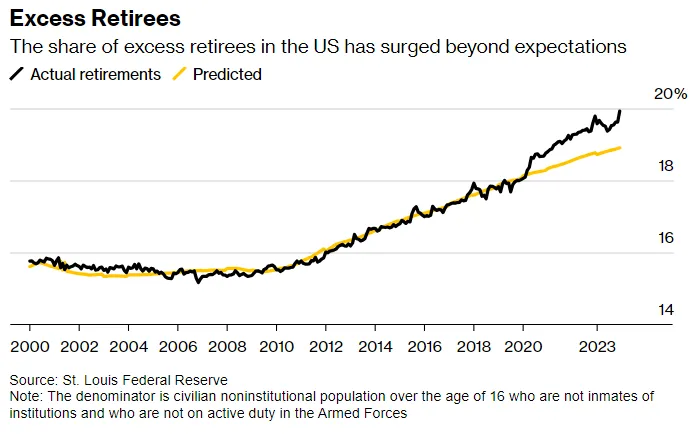

This week I note that, as Blake Millard illustrates in his newsletter, a massive shift in resources will result from record numbers of retirees. Blake cites several reasons for a 2.7 million uptick but stops short of speculating the impact. Personally, I agree with the notion that an increase in retirees will lead to more conservative investment strategies that could take some wind out of the stock market’s sales. Then again, everyone Gen X and younger continue to plow money into the stock market via 401(k)s, so who knows?

Gavekal, via Mauldin Econ’s “Over My Shoulder” provides confirmation that CRE is a real risk for regional banking, but not for the broader economy. We don’t really know how big the problem is because of lack of price transparency. Either way the CRE crisis could be bad for borrowers who rely on loans from regional banks.

Nvidia reported earnings this week, but it couldn’t stop the obsession or comparisons between the stock and Cisco during the dot com bubble. The trend line is eerily similar, but the chip maker is different than the network hardware manufacturer. For starters Nvidia’s GPU chips are dominant in the market, though they could eventually be challenged in the next few years. There is truly no equivalent to Nvidia, and it would require a massive collapse in the AI industry to trigger the same sort of quick downfall.

Eerily similar, personally don’t think NVDA crashes unless massive bankruptcies by AI startups

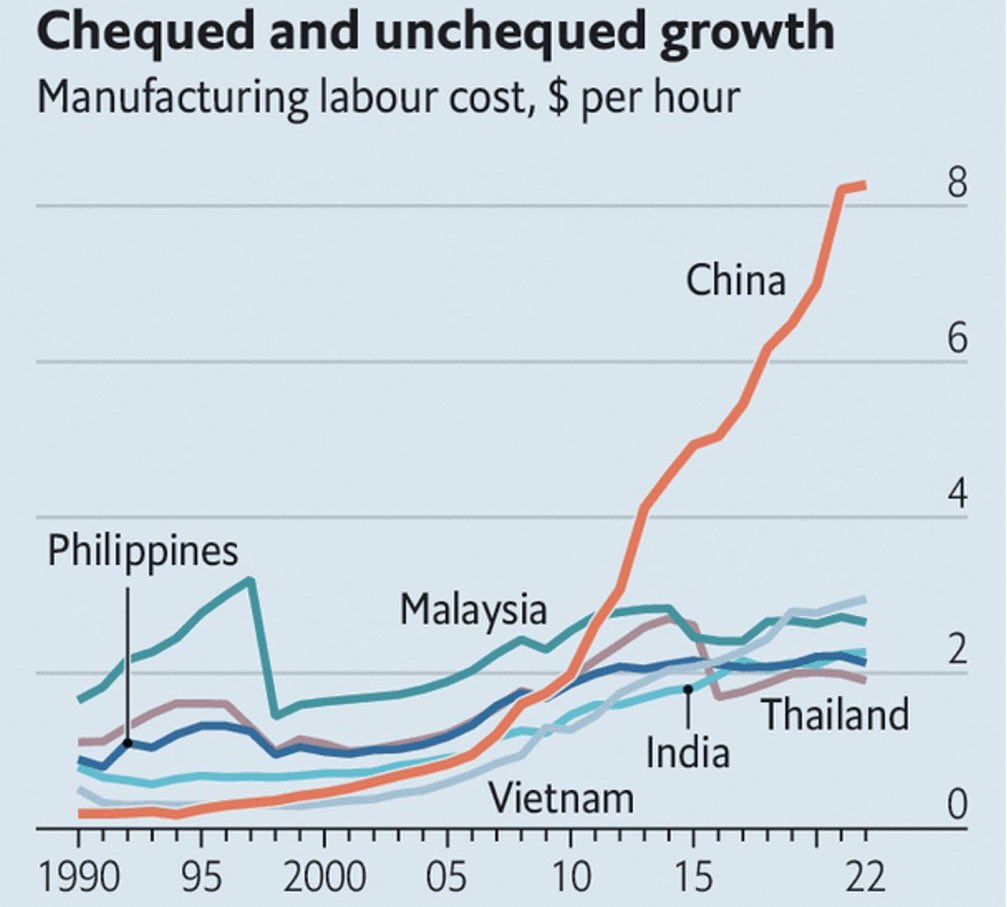

Regarding globalization, China has two problems: rising labor costs and a shrinking workforce. But as Mauldin Econ notes productivity can bridge the gap, at least for a while. Compound this with financial troubles in the real estate sector and I think China will lose a lot of ground to other Asian nations, but still retain the lead. Long term the success of home-grown solutions will dictate China’s position in the global supply chain.

Finally, Walmart is at it again. After a failed attempt at creating its own streaming service, the retailer is trying to buy Vizio. If you recall Walmart abandoned its service in 2019 to focus on Vudu (purchased in 2010), only to sell it in 2020. So why does Walmart want to buy a TV company? Advertising, or at least that is the bet. I think this initiative is outside of Walmart’s core competencies.

TOPICS

Labor Market

OBSERVATION - This massive shift in resources will impact markets as retirees move investments into more stable returns.

- (Blake Millard)

- Covid-19 caused the number to spike well beyond expectations

- United States now has roughly 2.7 million more retirees than predicted

- Investment portfolio values are up, home prices have risen post-pandemic, and a wave of companies enforcing return-to-office mandates have all contributed towards this phenomena.

- Covid-19 caused the number to spike well beyond expectations

Commercial Real Estate

OBSERVATION - Confirmation of trend we suspect: CRE risk in regional banking, but not broader economy.

- (Over My Shoulder)

- Gavekal’s Tan Kai Xian says US commercial real estate is having problems that will probably intensify, but they also aren’t likely to have serious macro effects.

- CRE sector is suffering from high vacancy rates

- Part of the problem is price transparency.

- Pain will instead flow toward small businesses reliant on bank loans

- NOTE: Highly recommend you read the full commentary and memo by GavekalResearch via Over My Shoulder

Stock Market

OPINION - Eerily similar, personally don’t think NVDA crashes unless massive bankruptcies by AI startups.

- (Over My Shoulder)

- Those of a certain age may recall the 1990s when Cisco (CSCO) was a high-flying stock and (briefly) the world’s most valuable company. It is shown in this chart as the blue line. The other line is an overlay showing Nvidia (NVDA) from 2020.

- MichaelAArouet - Never forget, this time it’s different.

Globalization

OPINION - Interesting point, but ignores the China’s economic struggles that will hamper output in the near term. Meanwhile the rest of Asia catches up.

- (Over My Shoulder)

- Globalization is about more than labor costs.

- Massive increase in China’s labor costs vs. some other Asian countries

- But the per-hour labor costs are just part of the equation

- Thesis that highly automated factories can overcome the gap

- MichaelAArouet - Geopolitics is not the only reason investors are leaving China, it’s simply much cheaper to produce in other countries

- Globalization is about more than labor costs.

Digital Media

OBSERVATION - Walmart tries the digital content market AGAIN.

- (Jim Cramer)

- Walmart is making so much money in advertising that it wants to dominate connected TV by buying Vizio for $2.3 billion