2023 Week 48

Notes, thoughts and observations - Compiled weekly

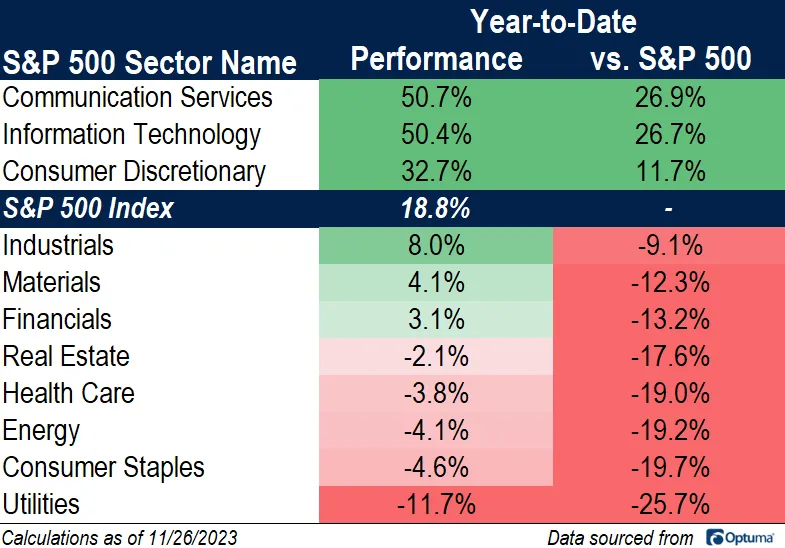

Where is the stock market going? If the yield curve and consumer spending is an indicator we could be headed for a recession. On the other hand, Black Friday card data says that spending may not be as weak as expected and the VIX indicates a new kind of bullishness not seen in a while. On thing is clear, sectors that performed well outperformed the S&P 500 by a significant amount.

Rent or buy? No not talking about a home, but rather machine learning cycles. Companies like Snowflake continue to grow amid high demand for Nvidia chips. Sometimes it makes sense to rent a server rather than rack your own hardware.

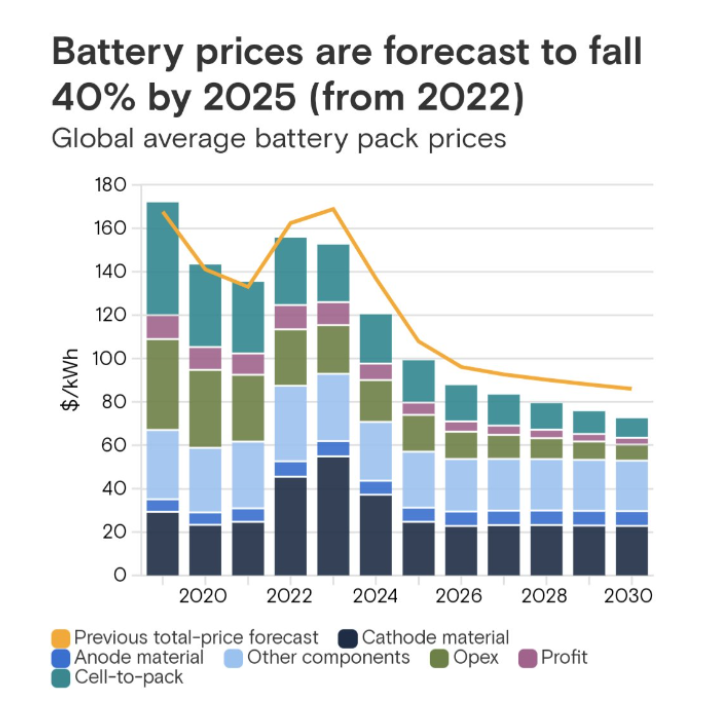

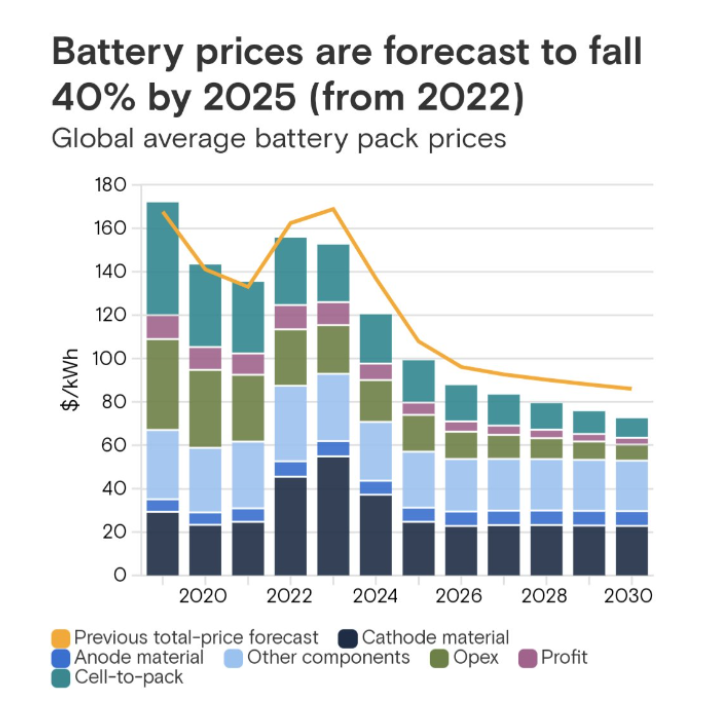

A couple of bright spots. First battery prices are expected to fall and newer technology will improve performance. Likewise, life extending technology like CRISPR gene editing is opening new possibilities in treatment. Finally, even though modular nuclear technology is a non-starter at the moment, the broader application of “hot rocks making steam” is still a benefit to reducing carbon output.

Anode and cathode material costs are important

TOPICS

- Consumer Credit

- Fed Rate

- Recession

- Battery Technology

- Cybersecurity

- Stock Market

- Life Extending Technology

- AI and ML

- Nuclear Power

Consumer Credit

- (Pragmatic Engineer) :: OBSERVATION - Inflation an underlying driver, as noted YOY might decline when adjusted

- Black Friday and Cyber Monday spending at all-time high

- Adobe Analytics: the firm estimated Black Friday online spending as $9.8B (up 7.5%) and Cyber Monday at $12.4B (up 9.6%) across the US (Bloomberg)

- Mastercard: US Black Friday e-commerce sales up 8.5%. Retail sales up 2.5% and in-store sales up 1.1%, the company reported. Because of inflation being 3.2% in the US, retail sales and in-store sales could have actually decreased as their normalized value.

- All signs point to people being willing and able to spend online. This signals that the economy is in a good place, which is good news for the tech sector.

- (Sam Ro) :: OPINION - Agree with Sam that we shouldn’t jump to conclusions, but spending would seem to be robust.

- Mastercard said Black Friday spending was up from last year, with gains in both online and in-store sales.

- Adobe Analytics reported that Black Friday spending online rose to a record $9.8 billion in the U.S.

- Shopify reported that its merchants did a record $4.1 billion in sales worldwide.

- All this shopping comes as a ton of people were traveling. According to the TSA, 2.9 million travelers were screened in U.S. airports on Sunday, making it the busiest day for air travel in history.

- NOTE: It’s generally not a great idea to jump to conclusions based on a couple days’ or weeks’ worth of data.

- (Cramer) :: OBSERVATION - Wall Street not certain, but I can see slower spending with my eyes

- Consumers may be increasingly budget-conscious, but spending continues to accelerate and looks set to do so through the holiday season, The Wall Street Journal reports.

- Conversely, a recent Morgan Stanley survey indicated consumers would not spend more this year.

- 11/21/2023 (Cramer) :: OBSERVATION - Deceleration in consumer spending

- Lowe’s (LOW) reports a decline in DIY sales, missing on third-quarter same-store sales and revenue. Decline is in bigger ticker appliances. The home improvement chain also cut its full-year earnings-per-share (EPS) and revenue outlook. The stock was dropping nearly 4% premarket.

- Shares of Best Buy (BBY) were falling more than 5% after the electronics retailer cut its full-year sales forecast as holiday bargain shoppers hunt for deals. Third-quarter EPS beat. Revenue missed.

- Kohl’s (KSS) beat on third-quarter EPS but missed on revenue and same-store sales. The retailer boosted the low-end of full-year earnings guidance and tightened the range on its expected year-over-year revenue decline. The stock dropped more than 5%.

Fed Rate

- (Blake Millard) ::

- The retreat in yields over the past month has been a reprieve for both stock and bond prices alike.

- Here are the current U.S. Treasury yields (blue) across the curve versus the peak yields (orange) during the current tightening cycle:

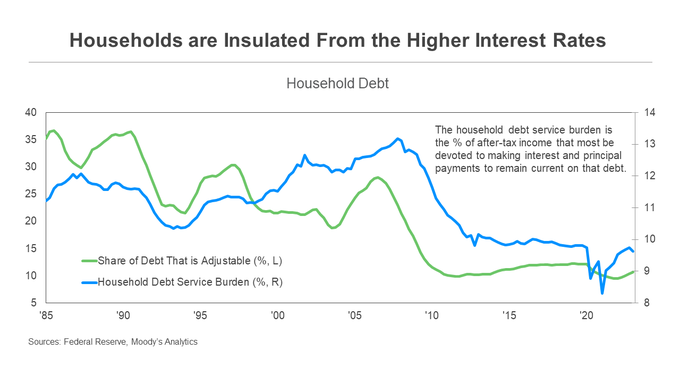

- (Markzandi) :: OBSERVATION - Counter narrative to doomers who say things are worse than ever. Data does not support this.

- The economy is meaningfully less interest rate sensitive than in times past.

- Many US households deleveraged after the 2008 recession.

- Were able to shift their debt burden into fixed-rate loans at historically low rates.

- Fed’s tightening had less effect than it would have 15 or 20 years ago.

- One segment that hasn’t deleveraged is the federal government. Much of its debt is relatively short term, too, and is now in the process of resetting to much higher rates.

Recession

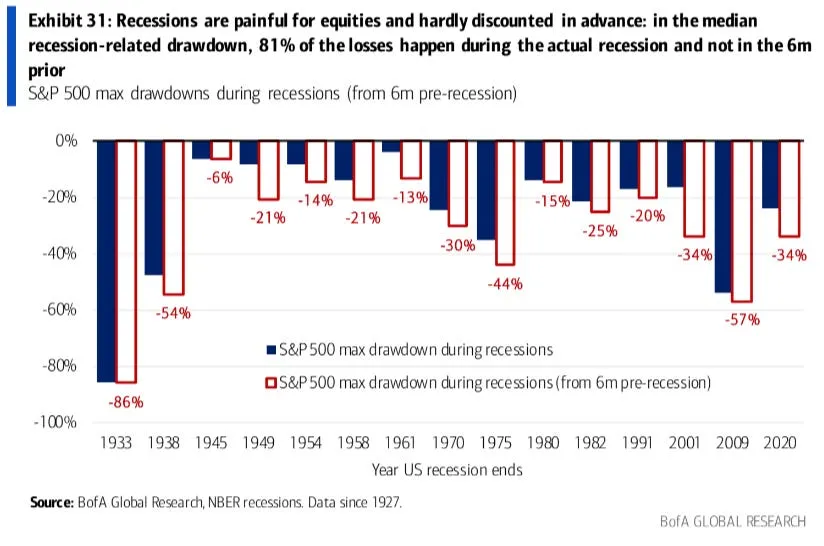

- (ChartStorm) :: OBSERVATION - So how do you explain the market downturn we just came through.. dare I say “recession”?

- This chart shows the drawdown in equities during recession (the dark blue bars) vs the drawdown including the time period 6-months prior to recession. For the most part the bars are fairly close together… or in other words, most of the pain comes during recession.

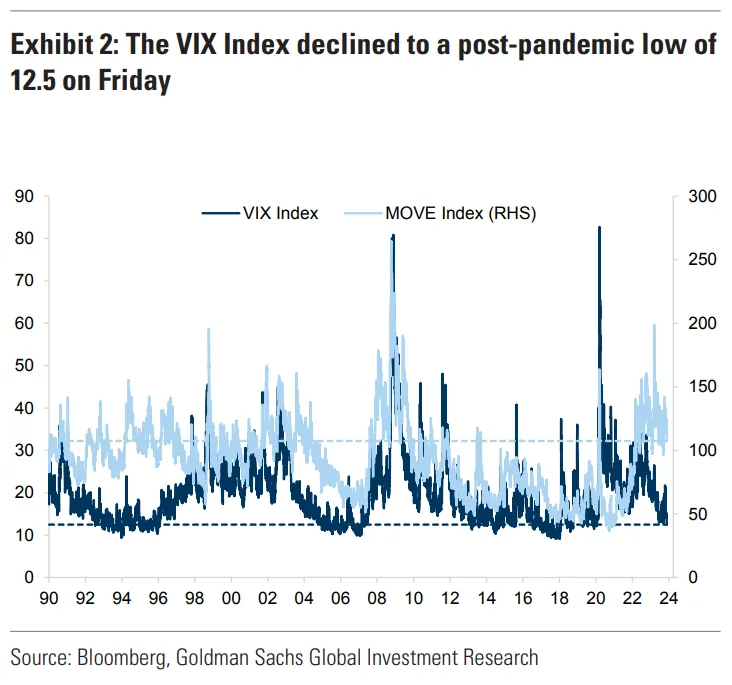

- (Blake Millard) :: OBSERVATION - Supports more speculation of a soft landing

- VIX Index declined to a post-pandemic low of 12.5 on Friday

- Cross-asset volatility has continued to reset lower across the board, supported by markets further embracing the more goldilocks backdrop in the U.S.

Battery Technology

- (MishTalk) :: OPINION - Margins will get squeezed, only the strong will survive

- This is so typical. “At some arbitrary horizon, we’re going to forecast a fairy tale outcome that is politically desirable/opportunistic.” I’m not blaming Bremmer here – I’m blaming GS. https://t.co/CMkfEB3qYA — Tony Nash (@TonyNashNerd) November 20, 2023

Cybersecurity

- (Seeking Alpha) :: OPINION - Reputational damage that will cause companies to switch to Okta’s competitors

- Okta’s stock fell about 6% premarket on Wednesday after the company said that it has found that hackers stole information on all users of its customer support system in a network breach two months ago.

- “We have determined that the threat actor downloaded the names and email addresses of all Okta customer support system users.”

- The company will also notify individuals that have had their information downloaded.

- Okta is scheduled to report its third-quarter earnings on Wednesday after market close.

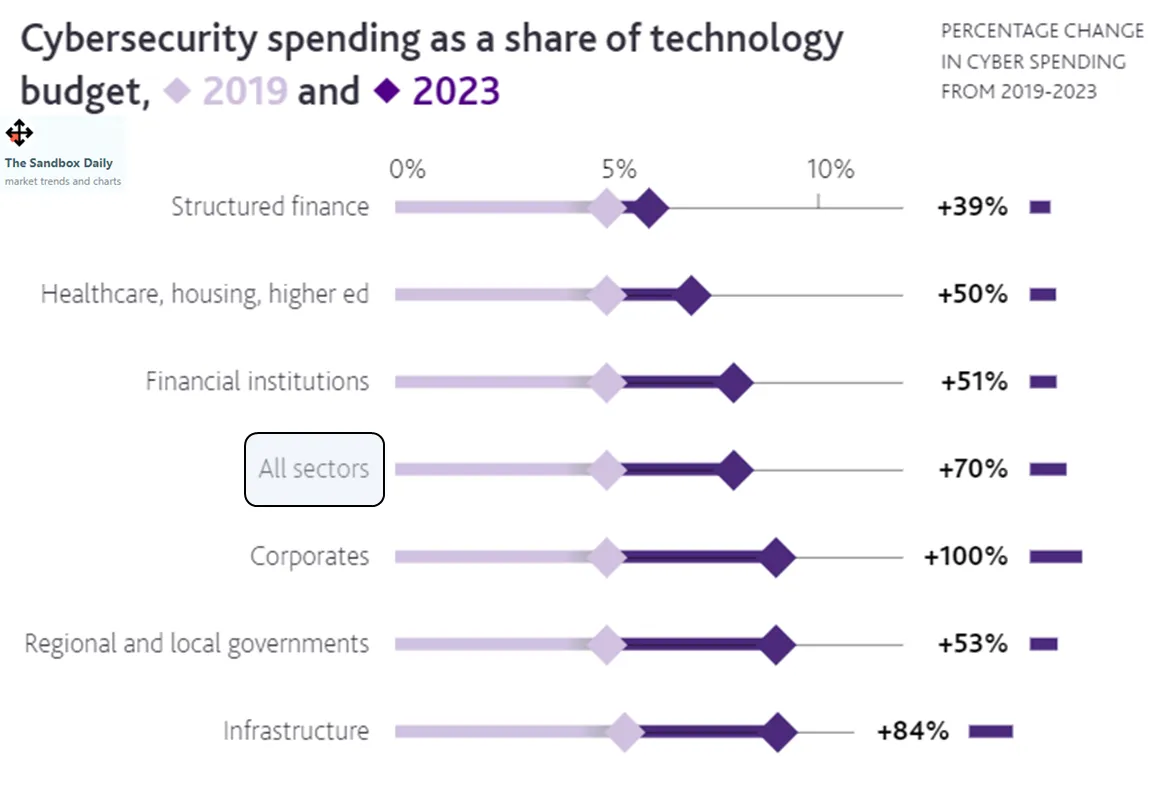

- (Blake Millard) :: OBSERVATION - Spending increases on cybersecurity

- AI’s potential for transformation is without question the story of 2023

- However, AD-driven advancements in cyber warfare pose an emerging geopolitical and business security threat with the potential to cause systemic destabilization, with cyberattacks supercharged through AI-enhanced surveillance as well as disinformation campaigns.

- Nearly 50% of business leaders indicate that geopolitical instability is causing them to re-evaluate the countries with which they do business

- Businesses are backing up their words with action

- Moody’s survey highlights that cybersecurity spending as a share of technology budget has increased by 70% across all sectors between 2019 and 2023.

- AI’s potential for transformation is without question the story of 2023

Stock Market

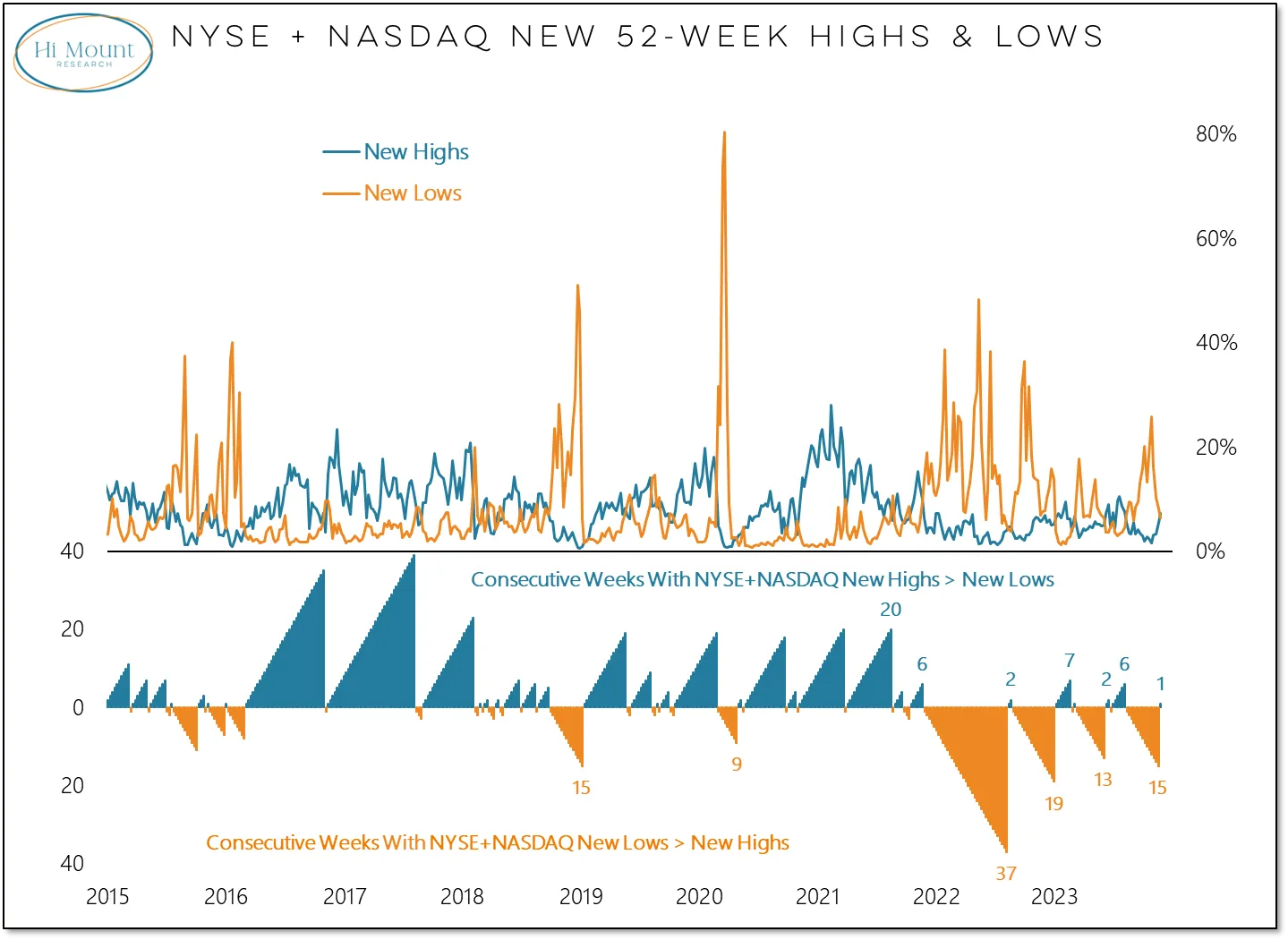

- (Blake Millard) :: OBSERVATION - Still uncertain of a new bull market, results indicate otherwise

- Lowest share of stocks outperforming the index in over three decades

- To be clear, the story isn’t 7 stocks going up while 493 are going down. Quite the contrary.

- 6 of the 11 index sectors are green in 2023

- Perhaps the winds are changing as we speak, though – more stocks made new 52-week highs than lows for the first time in 16 weeks.a

- After all, in bull markets, more stocks are going up than going down.

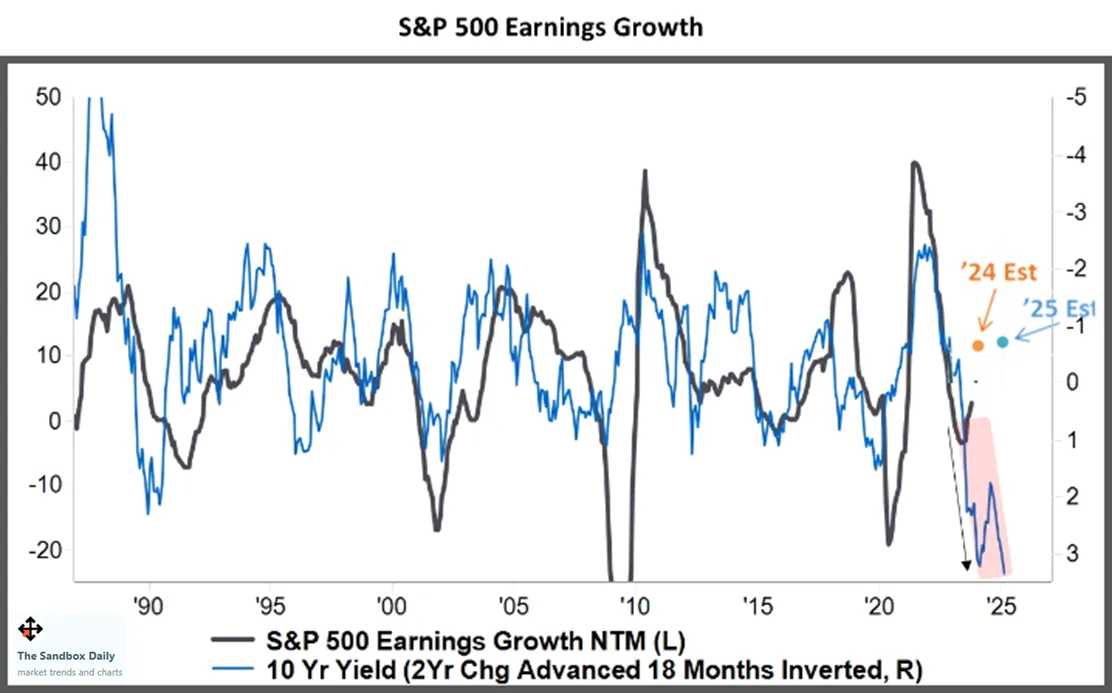

- (Blake Miller) :: OBSERVATION - Is this what a soft landing looks like?

- The bigger earnings question is whether or not current 2024 and 2025 expectations can materialize. Many do not believe so.

- Currently, expectations are for EPS margins to grow +11.4% in 2024 and +12% for 2025. While anything is possible, an acceleration of that magnitude would be unprecedented with so much tightening in the system.

Life Extending Technology

- (Gladstone) :: OBSERVATION - Gene editing continues to be a viable advanced medical treatment.

- CRISPR-Powered ‘Cancer Shredding’ Technique Opens New Possibility for Treating Most Common and Deadly Brain Cancer

- “Glioblastoma is the most common lethal brain cancer, and patients still don’t have any good treatment options,”

- Until very recently, CRISPR has been used mainly in the development of therapies or as a valued research tool, but not as a treatment modality in itself.

- That changed in mid-November when UK regulators approved the first CRISPR-based therapy, which is designed to cure sickle cell disease and beta thalassemia.

- In the US, the FDA is expected to issue a decision on the same therapeutic approach in early December.

AI and ML

- (Cramer) :: OPINION - Valid point, it makes sense to rent cycles rather than rack servers for some companies.

- Snowflake (SNOW) shares popped more than 8% after its earnings beat. The AI from Nvidia (NVDA) is too expensive, so why not rent the cloud and analytics and AI from these guys, as Yum! Brands (YUM) does.

- (CNBC) :: OPINION - This is fanciful. I haven’t seen this large a hype cycle since the dotcom bubble.

- Nvidia CEO Jensen Huang says AI will be ‘fairly competitive’ with humans in 5 years

- (Seeking Alpha) :: OPINION - Self-driving was a near-term hype cycle

- GM’s Cruise co-founder Daniel Kan quits a day after CEO exit

- resigned just a day after its CEO Kyle Vogt stepped down.

- Senior executive exits come less than a month after Cruise suspended operations, issued recalls and halted production of its autonomous vehicles (AVs) amid safety concerns.

- Cruise is under investigation by the National Highway Traffic Safety Administration after a hit-and-run incident in San Francisco, which ended with a Cruise AV dragging a pedestrian.

- GM’s Cruise co-founder Daniel Kan quits a day after CEO exit

Nuclear Power

- (Peter Zeihan) :: OPINION - Modular was a long shot, but nuclear remains a good alternative for steady state power generation

- Modular Nuclear Reactors Are Not the Future of Energy

- As we enter a period of capital scarcity and top-heavy demographics, many companies working on these modular nuclear reactors have been forced to abandon ship. This complication adds another layer of complexity to the growing energy demands of the next decade.