2023 Week 44

Notes, thoughts and observations - Compiled weekly

A major theme over the past few weeks has been the unwinding of the cheap debt economy. Experts predict this will lead to increased bankruptcies, failed start-ups and zombie companies. WeWork made it official by filing for Chapter 11 this week, while many companies are looking at a “Maturity wall” in 2025 and will need to rollover five-year loans into higher interest rates.

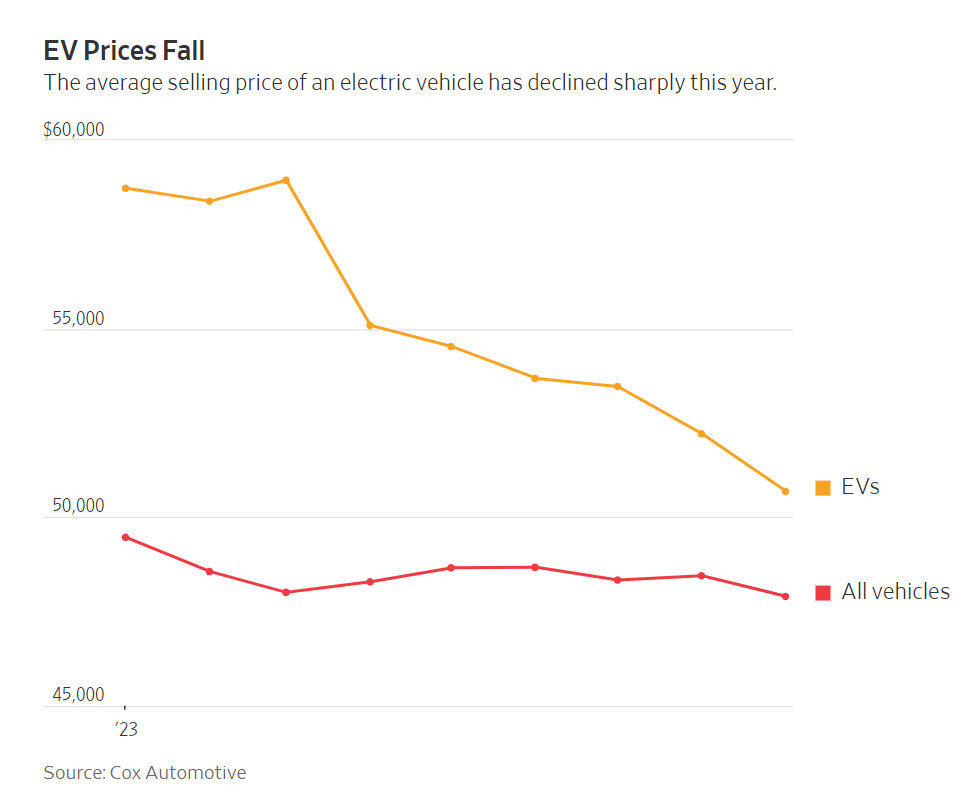

Despite current exuberance for a soft landing, indicators of the dismal science point toward falling demand means softening consumer activity. Homeowners are locked into mortgages with the golden handcuffs of low interest rates. Automotive retailers also report a failing demand for EVs as the vehicles pile up on lots.

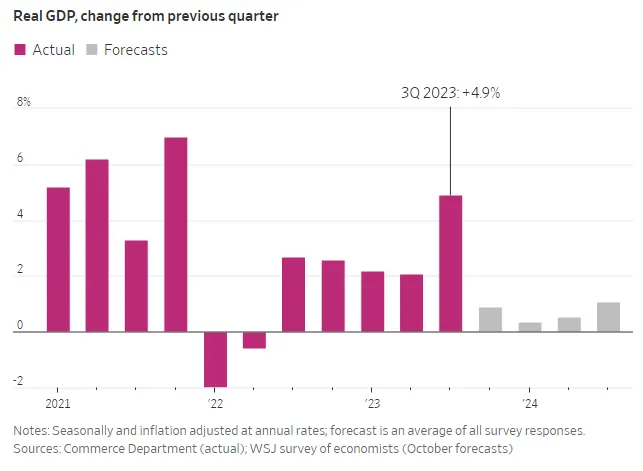

Though GDP expanded at an 4.9% annualized rate economist still think that there is trouble ahead. The yield curve remains inverted and an under investment in traditional fuel sources likely mean lower supply and higher prices in the future.

Large amount of money is going into energy efficiency

TOPICS

Bankruptcy

OBSERVATION - Slow roll toward bankruptcy

- (Seeking Alpha)

- WeWork poised to file for Chapter 11 bankruptcy next week

- Early this month, WeWork (WE) missed two sets of interest payments totaling ~$95M. It received a 30-day grace period before the non-payment becomes a default event.

- On Tuesday, it reached an agreement with bondholders for seven more days to negotiate with stakeholders before it’s declared in default.

- In 2019, the company was valued at as much as $47B. Its market cap now stands at ~$185M.

Fed Rate

OPINION - Disagree that rates are “hurting” the economy, they are at “normal levels” as Howard Marks states.

- (Barry Ritholtz)

- The Fed is Finished* - “not sure if they quite recognize the potential damage they are doing to the economy.”

- Lack of Single Family Homes

- Low Mortgage Rate Golden handcuffs

- Owner’s Equivalent Rent

- The Fed is Finished* - “not sure if they quite recognize the potential damage they are doing to the economy.”

OBSERVATION - “Maturity wall” in 2025, rolling over five-year loans

- (Over My Shoulder)

- The economy is growing at about a 3% pace.

- A strong job market, real income gains and continued strong business investment all combined to produce the growth.

- Data is unlikely to make the Fed change course

- The economy will hit a “maturity wall” in 2025 as borrowers begin rolling over five-year loans set at historically low rates in 2020.

Recession

OBSERVATION - Falling demand means softening consumer activity?

-

(MishTalk)

- ISM Manufacturing Plunges to 46.7 Percent. New Orders, Backlogs in Contraction

- Expected to hold steady at 49.0

- Instead, it went into significant contraction with a steep drop in employment.

- The most telling statistic is that eighty-nine percent of panelists’ companies reported ‘same’ or ‘lower’ prices in October.

- Overall weakness in prices can be attributed to falling demand, not strikes, And it’s despite artificial demand spurred by the Inflation Reduction Act.

- ISM Manufacturing Plunges to 46.7 Percent. New Orders, Backlogs in Contraction

OBSERVATION - Wow dude, almost like we had a recession back in ‘22

-

- The U.S. economy’s report card showed that GDP in the 3rd quarter expanded at a 4.9% annualized rate (inflation-adjusted).

- Consumer spending has continued to defy expectations and chug along. It grew +4.0% in Q3, way up from +0.8% in Q2.

- Economists expected that high prices and persistent inflation would stop people from spending.

- But in September, U.S. retail sales crushed expectations while the labor marked added 366k jobs, once again confounding the experts.

- Bottom line: The resilient economy likely reflects longer-than-expected policy lags, likely due to the substantial fiscal stimulus to households and businesses in response to the pandemic.

Real Estate

OPINION - Disagree that rates are “hurting” the economy, they are at “normal levels” as Howard Marks states.

- (Barry Ritholtz)

- Low Mortgage Rate Golden handcuffs:

- Approximately 60% of homeowners with a mortgage have rates of 4% or lower.

- Prevents people from moving to a new home, regardless of whether they’re moving up or downsizing.

- Rates between 7 and 8% simply make the monthly carrying costs too pricey; this is true regardless of the purchase price.

- Low Mortgage Rate Golden handcuffs:

Corporate Debt

OPINION - Cost of debt service will hit a lot of companies bottom line, recession or not.

- (Mauldin Econ)

- Maturity Wall - 2024 will be more than double this year’s maturities

- If corporations hit this maturity wall at the same time demand for their products weakens, the problem could easily spread. That’s how recessions often start.

EV Technology

OBSERVATION - Multiple sources confirm the declining demand by NEW EV owners

-

(MishTalk)

- Consumers Don’t Want EVs

- Despite subsidies, EVs are piling up on dealer lots. Prius hybrids have a 1-week supply. The Mustang Mach-E SUV has a 3 1/2 month supply.

-

- Toyota to invest $8 billion and add about 3,000 jobs at its battery manufacturing plant in North Carolina to support electric vehicles.

- Earlier in June, the world’s biggest car maker announced an ambitious plan to launch commercial solid-state batteries as soon as 2027

Environment

OBSERVATION - Natural gas is at it’s lowest, but will certainly be part of the energy future if only for heating and electricity production

-

- Trends:

- A sharp decline in natural gas investment since 2015

- “Low-emissions power” (i.e., solar, wind, etc.) is now drawing more new investment than oil

- Large amount of money is going into “energy efficiency”

- Trends: