Category:

Business

2023 Week 20

Notes, thoughts and observations - Compiled weekly

A lot of noise this week and not much meaningful signal. Home Depot missed on revenue which indicates consumer weakness. Contrary, private debt continues to climb despite rising insterest rates and the labor market remains sutbornly strong.

TOPICS

OBSERVATION - More consumer weakness, but is this short term?

- (Keith Fitz-Gerald)

- Home Depot worst revenue miss in 20 years

- posted the worst revenue miss in 20 years, citing consumers who are delaying purchases to cope with inflation and generally poor economic conditions.

- Investing takeaway: The markets are all about psychology right now, so information like this is gonna weigh on the major indices.

- Home Depot worst revenue miss in 20 years

Credit Crunch

OBSERVATION - Consumers weaker than expected

- (Sandbox Daily)

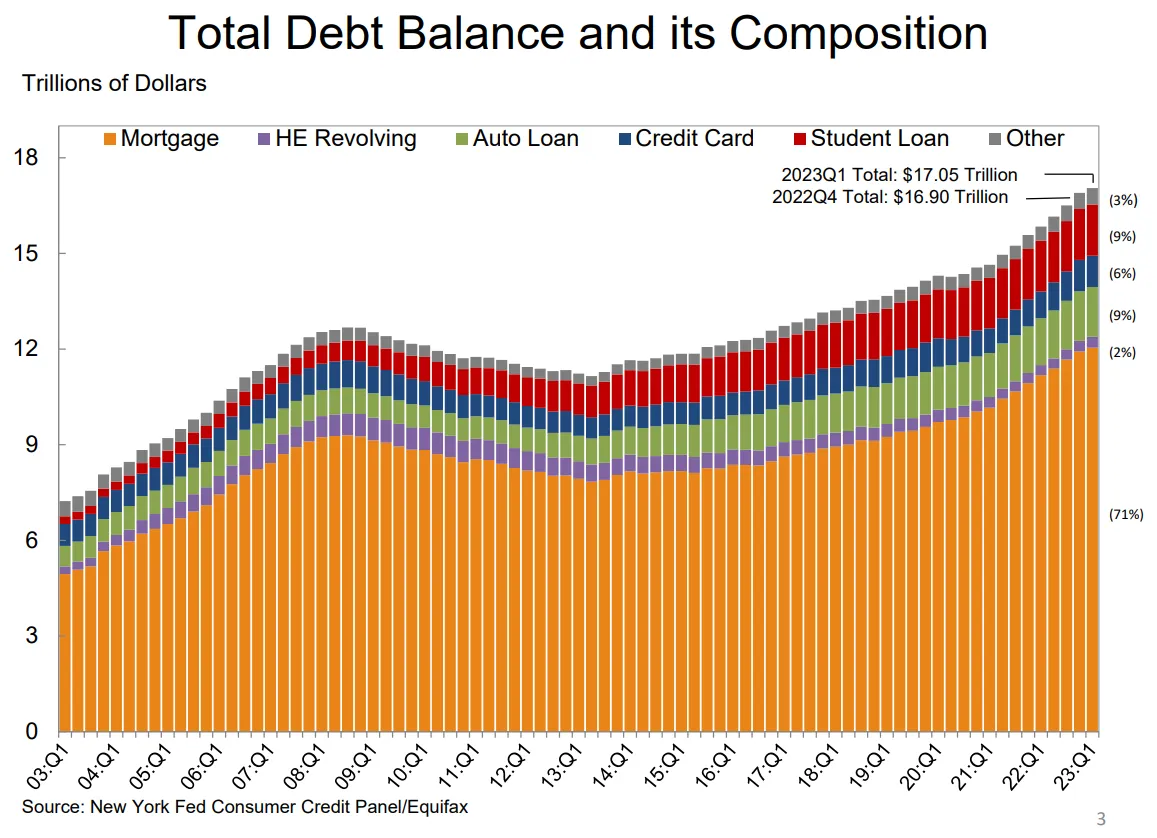

- Total U.S. debt surpasses $17 trillion dollars

- Mortgage balances climbed by $121 billion and stood at $12.04 trillion at the end of March.

- Auto loan and student loan balances also increased to $1.56 trillion and $1.60 trillion, respectively, but credit card balances were flat at $986 billion.

- Since the pre-pandemic era in 2019, the debt load has increased by $2.9 trillion, $148 billion (or 0.9%) of which came between January and March 2023.

- Total U.S. debt surpasses $17 trillion dollars

- …

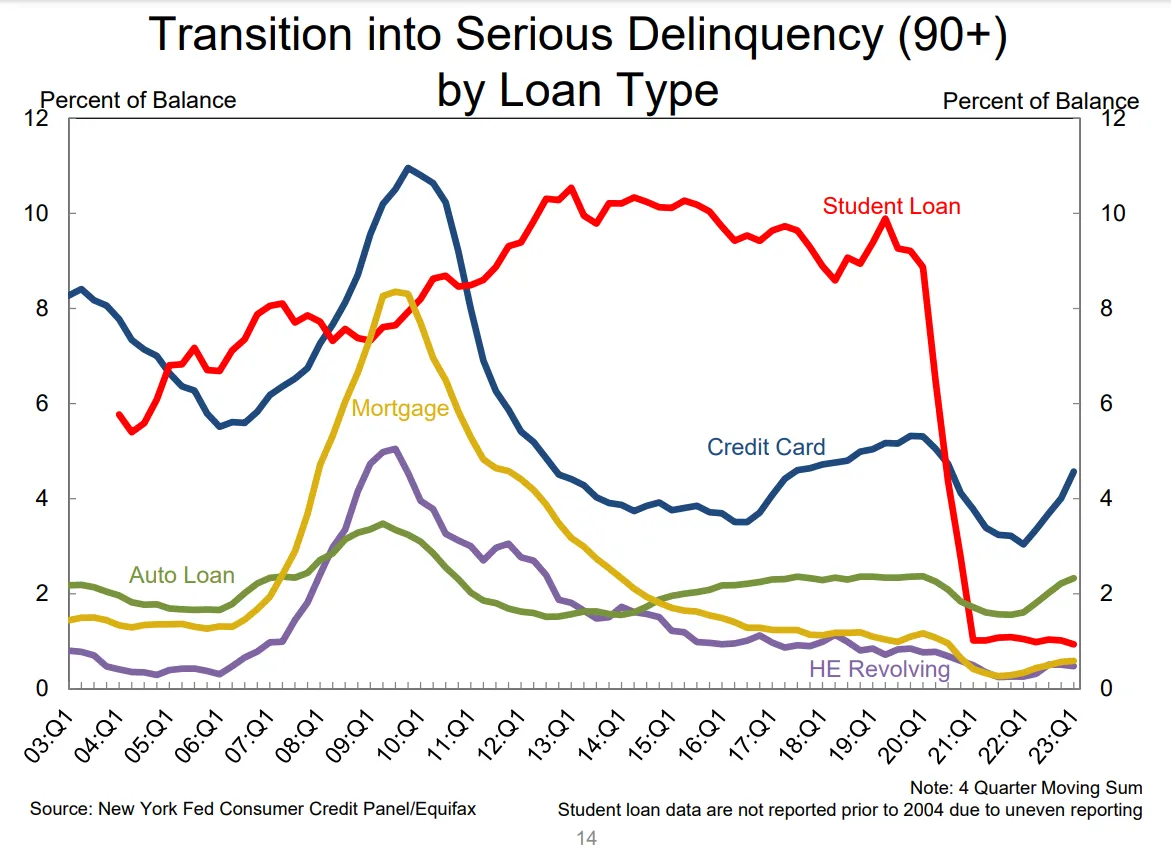

- Elsewhere, credit card and auto loan delinquencies are ticking up across the board.