2023 Week 5

Notes, thoughts and observations - Compiled weekly

TOPICS

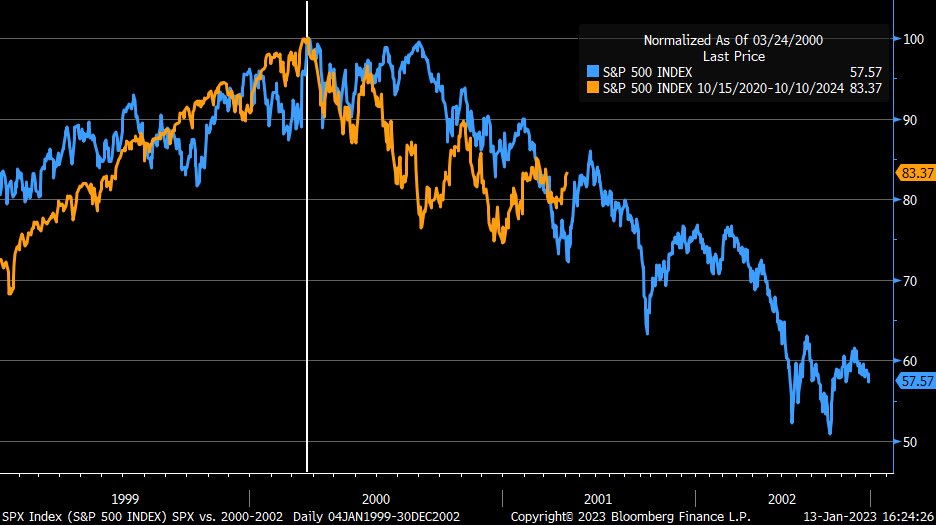

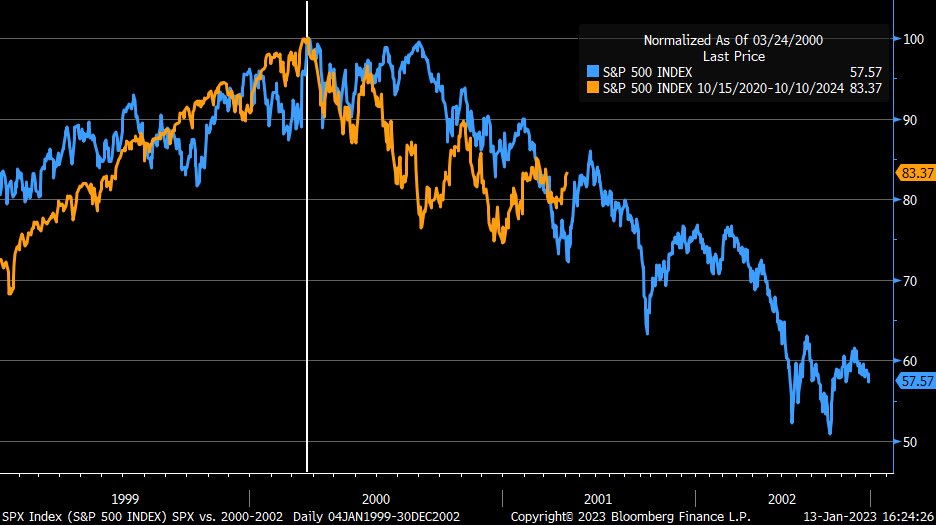

Compare current market (orange) to the tech bust in early 2000s (blue)

Ad Revenue

The End of Free

I wrote a second article about the end of Dot-com Bubble 2.0 speculating that the recent decision by Twitter to monetize it’s API is only the begining. Last week I noted that ad revenues are down across the board and think that this could hurt the bottom line of many ad support (e.g. free) services.

Starting February 9, we will no longer support free access to the Twitter API, both v2 and v1.1. A paid basic tier will be available instead 🧵

— Developers (@XDevelopers) February 2, 2023

We don’t have a final number on the cost, but I speculate that services will either begin charging a fee, require users to purchase and provide their own key, or simply shut down the service. This may become a larger trend in the industry as investors clamor for profitability and income from advertisement declines.

Stock Market

It’s beginging to look a lot like 2000

- Everyone take a look at this chart from my friend Jim. Does this constitute a trendline break?

via biancoresearch

- S&P 500 rejected again when approaching downtrend line

- No two bear markets are identical, but interesting to compare current one (orange) to that associated with tech bust in early 2000s (blue) … both indexed to 100 at respective peaks (Past performance is no guarantee of future results)

Recession

Numerous econ thinkers speculate that the worst is yet to come

(Thoughts from the Frontline) - 2023 could be the pause that refreshes… before a much worse 2024.

- “My calculations of trendline value of the S&P 500, adjusted upwards for trendline growth and for expected inflation, is about 3200 by the end of 2023.” - Jeremy Grantham

- “Other factors suggesting a long or delayed decline include the fact that we start today with a still very strong labor market, inflation apparently beginning to subside, and China hopefully regrouping from a strict lockdown phase that has badly interfered with both their domestic and international business…” - Jeremy Grantham

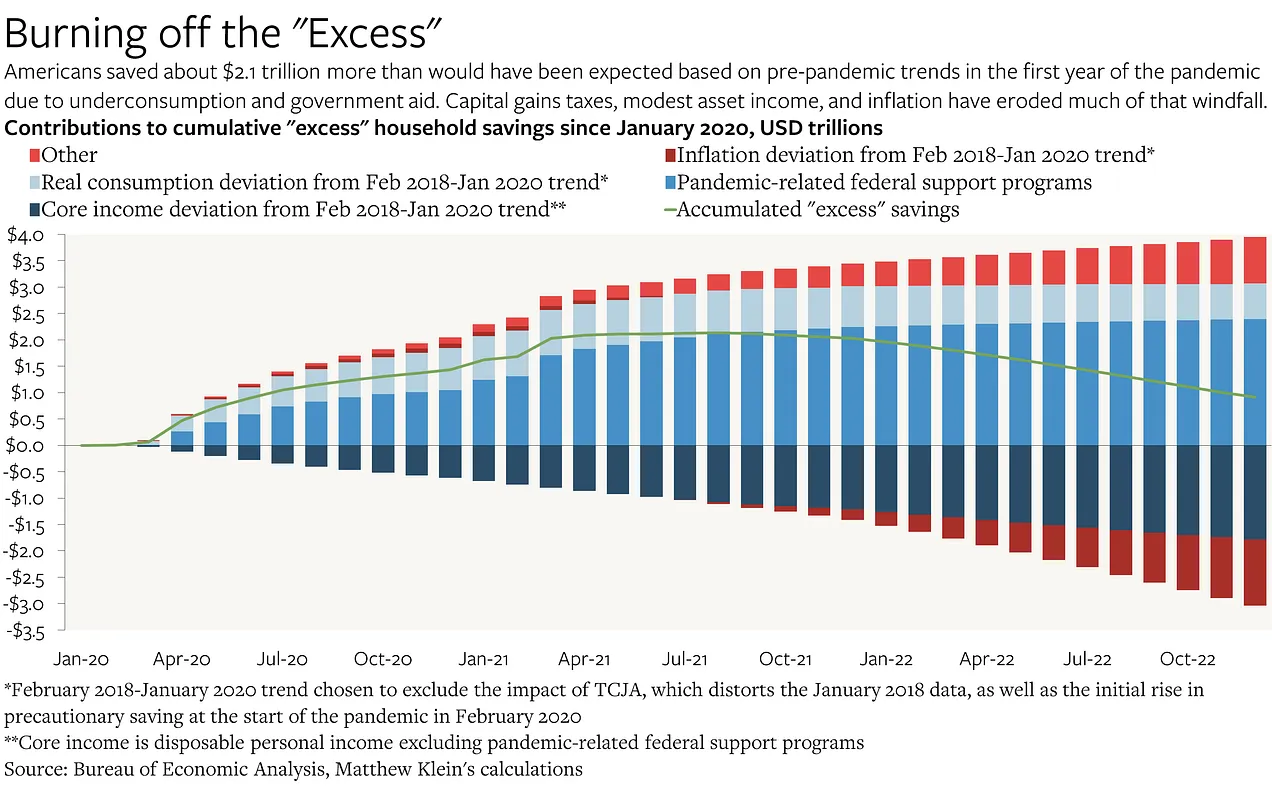

- “..but most analysts put the peak of excess savings at $2‒3 trillion in late 2021. This excess savings balance has been slowly drawn down over the course of 2022, but less than half now remains. Once it runs out, by some estimates around mid-year, this particular support for the economy will be gone.” - Jeremy Grantham

- “Further to that point, markets usually don’t bottom until 7‒8 months after a recession starts, which hasn’t officially happened yet.” - John Mauldin

- I believe the Fed is going to keep rates high(er) for some time and continue quantitative tightening as assets roll off the balance sheet. There will be no rate cuts this year, barring some really serious event. - John Mauldin

OPINION - Once savings are used up, impact of inflation and job loss will mount in the consumer sector

- Americans liquidated more than $1 trillion of “excess” savings in 2022, eliminating more than half of the surplus accumulated since the pandemic began. If the current pace continues, the entire stock will vanish by the end of this year.

-

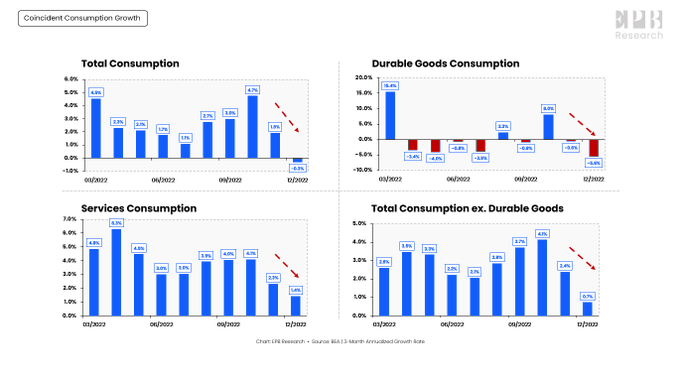

Consumer spending growth is decelerating in every major category, from services to goods. The squeeze on households is becoming clear.