Category:

Business

2022 Week 39

Notes, thoughts and observations - Compiled weekly

THIS WEEK

Inflation

- (Over My Shoulder) :: Inflation is a process, not an event, in which the effects of each stage flow from the last one.

- Bottom Line: Dalio estimates inflation will stabilize around 4.5% and the Fed will hike interest rates to that same level or slightly higher. This will produce about a 20% drop in stock prices and a significant economic contraction.

OBSERVATION :: 4% is closer to the long term average, could we see the Fed raise their target inflation rate?

Labor Market

Maintain austerity in good times to avoid layoffs in bad times. - Carlos Slim

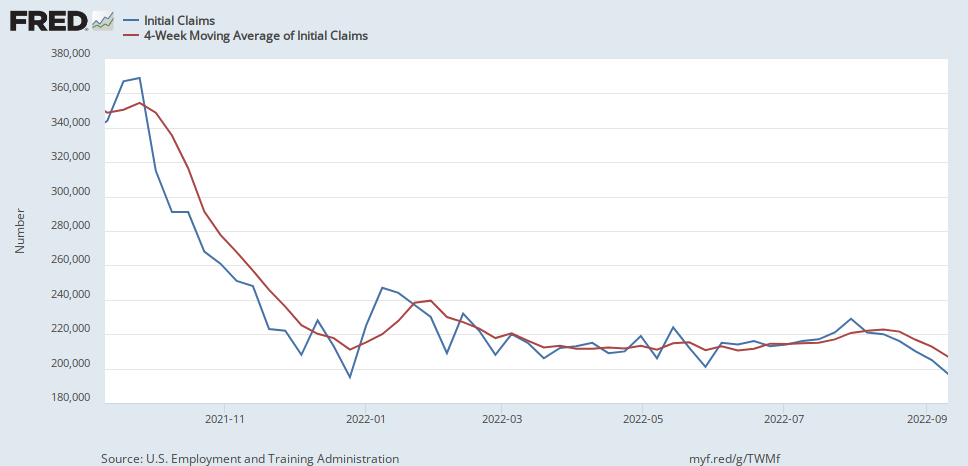

- (Clips that Mater) :: Weekly unemployment benefit claims may have peaked last month.

- (Cramer) :: My survey of 10 CEOs and two CFOs in my travels over the past couple weeks show that WITHOUT A DOUBT there are more people to hire and hiring is no longer difficult.

- This is a MAJOR departure from what I have heard every time I have been with CEOs. MAJOR.

- (EPBResarch) :: Labor market is set to weaken massively in the coming 3-6 months.

- The economy has been slowing for over a year, but we haven’t seen mass layoffs yet.

- Labor Market is the most lagging of the coincident data points, so it’s not unusual to see employment hang on until the recession actually begins..

- There is a sister survey in the jobs report called the “Household Survey.” The Household survey samples households rather than businesses.

- Household Survey has been much weaker, showing job LOSSES in two of the last four months. Again, something changed around April…

- This is NOT unusual for an economy entering recession but not quite there yet.

- Leading indicators can’t just look good on a chart. A great example is hours worked.

- Reducing someone’s hours is an easier thing for employers.

- Companies reduce people’s hours before going through the process of layoffs because the slowdown could be temporary,

- Why Mass Layoffs Haven’t Started Yet

OBSERVATION :: Labor market cooling is the last leg of the recession stool. Demographic challenges indicate it might not fall very far

Real Estate

Location, location, location

- (Liz Ann Sonders) :: Average 30y mortgage rate now back to late-2008 levels

OBSERVATION :: Will further slow down the real estate a residential construction

Globalization

Globalization is a fact of life. But I believe we have underestimated its fragility. - Kofi Annan

- (Zeihan on Geopolitics) :: American embargo to restrict chip technology to China

- China consistently unable to produce chip manufacturing equipment

- Already restricted aerospace export

- Expect to hit energy, agriculture and automotive